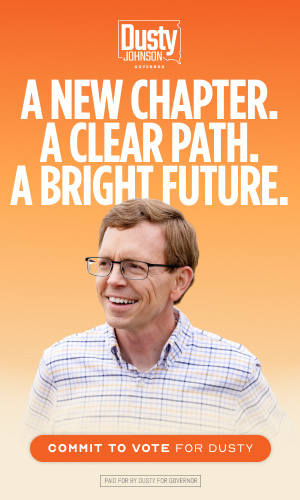

Dusty Johnson Secures Tax Relief, Border Security, and Historic Spending Reduction

Johnson Secures Tax Relief, Border Security, and Historic Spending Reduction

Washington, D.C. – Today, U.S. Representative Dusty Johnson (R-S.D.) voted to pass the conservative reconciliation package, the One Big, Beautiful Bill, to protect families, small businesses, and communities across America from the largest tax increase in American history. The bill now heads to President Trump’s desk for his signature.

“After struggling with the burden of inflation for the last four years, families and businesses are desperate for tax relief, and this bill has it,” said Johnson. “Our state is counting on the provisions in this bill for extension of current tax rates to see our businesses and communities grow and thrive. This bill is pro-family, pro-small business, pro-energy, and pro-America. I’m proud to send it to President Trump’s desk.”

The three most important parts of the package:

- Avoids a historic tax hike for most Americans and businesses.

- The bill includes no tax on tips, no tax on overtime, and provides $6,000 of tax relief for seniors.

- Without extending current tax rates, the average taxpayer in South Dakota would see a 25% tax hike.

- Without extending current tax rates, an average South Dakota family would see a tax increase of $2,500.

- Without extending current tax rates, 101,690 South Dakota families would see their household’s Child Tax Credit cut in half.

- Without extending current tax rates, 94% of South Dakota taxpayers would see their guaranteed deduction slashed in half.

- Without extending current tax rates, 88,730 South Dakota small businesses would see their tax rates surge to 40 percent.

- Without extending current tax rates, the National Association of Manufacturers expects South Dakota would lose 17,000 jobs, $1.5 billion lost wages, and $3.1 billion lost economic output.

- Secures our borders.

- It will complete 701 miles of primary walls, 900 miles of river barriers, 629 miles of secondary barriers, replace 141 miles of vehicle and pedestrian barriers, and strengthen border surveillance technology.

- It funds “Remain in Mexico” enforcement and at least one million annual removals of illegal aliens, ensuring immigrants come to the U.S. the right way.

- Hires thousands of Border Patrol and Immigrations and Customs Enforcement (ICE) personnel to carry out the mission.

- Implements commonsense policies to right-size federal programs and decrease spending.

- It saves $1.6 trillion over 10 years, the largest spending reduction in a generation.

- It changes Medicaid eligibility for certain non-citizen alien groups, protecting the program for the neediest Americans.

- It removes SNAP eligibility for illegal immigrants, ensuring Americans who need assistance the most receive it.

- It removes certain non-eligible aliens from receiving Medicare benefits.

- It enforces work requirements for able-bodied adults without dependents under the age of 14 who receive SNAP or Medicaid benefits, helping to lift them out of poverty. These work requirements will not affect vulnerable populations like pregnant women, seniors, those with disabilities, or those with young children at home.

Notable Johnson priorities included:

- Incorporates Johnson’s bill, the America Works Act of 2025, by strengthening work requirements for able-bodied adults without dependents receiving SNAP.

- Unleashes domestic mining of critical minerals, decreasing reliance on China.

- Provides $4.5 billion for the B-21 at the Ellsworth Air Force Base.

- Increases support for farmers facing higher costs for fuel, feed, and fertilizer due to record inflation.

- Makes long-term investments in conservation efforts that protect working lands without tying producers’ hands.

- Increases funding for trade programs so American-grown products reach more global markets.

- Prevents implementation of harmful Biden-era staffing standards for long-term care facilities.

- Prevents facilities that conduct abortions, like Planned Parenthood, from receiving federal Medicaid payments.

- Provides $50 billion investment in rural health care.

- Boosts defenses against foreign animal diseases that threaten our livestock and poultry industries, like New World Screwworm, Highly Pathogenic Avian Influenza, and African Swine Fever.

- Provides historic funding for the Air Traffic Control system, which is overdue for updates.

###

PIERRE, S.D. – South Dakota Attorney General Marty Jackley discussed federal and state law enforcement partnerships last week with FBI Director Kash Patel.

PIERRE, S.D. – South Dakota Attorney General Marty Jackley discussed federal and state law enforcement partnerships last week with FBI Director Kash Patel. I hate to point out in that bio he left out a couple of more recent episodes where he was in the news for…things..

I hate to point out in that bio he left out a couple of more recent episodes where he was in the news for…things..

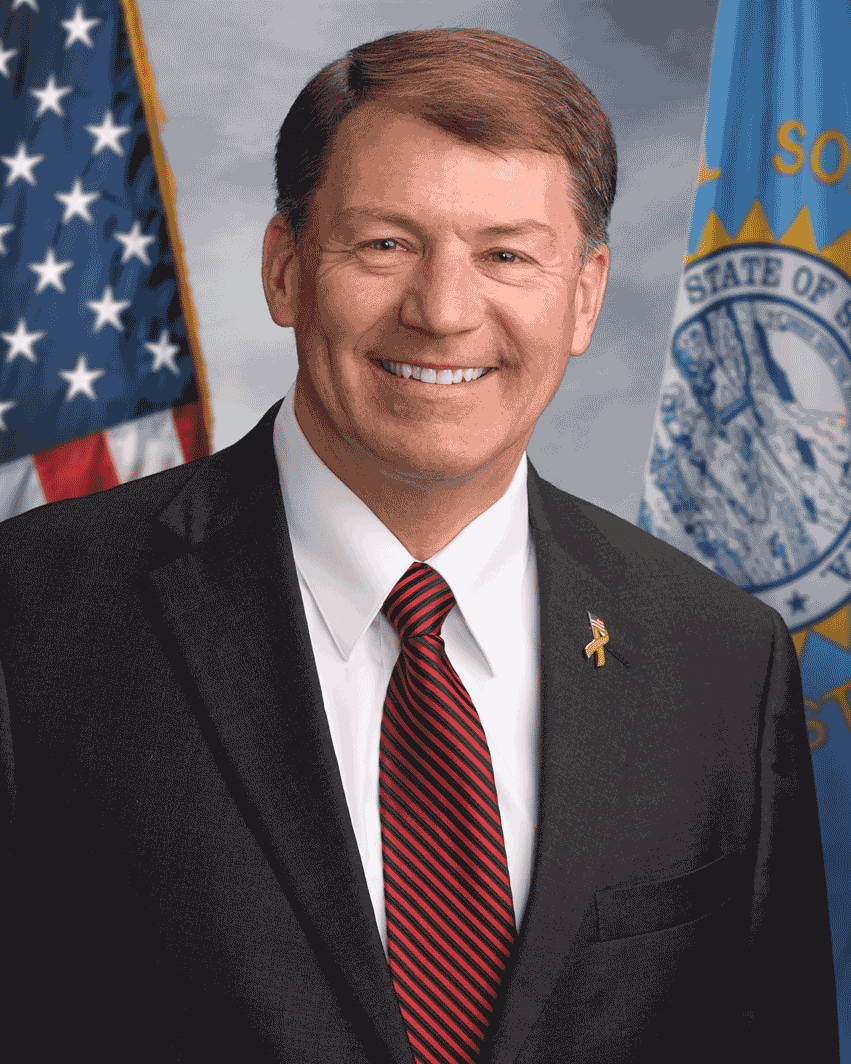

WASHINGTON – U.S. Senator Mike Rounds (R-S.D.) today released the following statement after the reconciliation bill passed the Senate by a vote of 51-50, with Vice President Vance breaking the tie:

WASHINGTON – U.S. Senator Mike Rounds (R-S.D.) today released the following statement after the reconciliation bill passed the Senate by a vote of 51-50, with Vice President Vance breaking the tie: