Biden’s Backdoor Death Tax

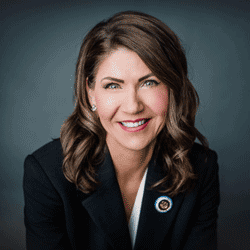

By: Governor Kristi Noem

June 25, 2021

Over the past year, our farmers and ranchers went to work every day to feed this country during a time of great challenge and uncertainty for millions of Americans.

How does President Biden plan to thank them? By raising their taxes.

The so-called “American Families Plan” would create a backdoor death tax on family farms and millions of other small businesses.

For decades, our tax code has protected farmland from being double-taxed when it is passed on to the next generation by ensuring that a capital gain is not realized at the time of death and transfer – otherwise known as a step-up in basis. But President Biden needs more money to pay for his $1.8 trillion wish list of big government programs, and he’s expecting hardworking Americans to pick up the check. His tax plan would eliminate step-up in basis and impose a capital gains tax of up to 43.4 percent on unrealized gains valued at over $1 million. President Biden claims that this will only impact the wealthiest Americans. Unfortunately, that’s not the case.

Farmers and ranchers tend to own large amounts of valuable land, equipment, and livestock that makes them appear wealthy on paper, but they often have very little cash on hand. They spend years incurring great costs to make their land more productive, but they never know each year whether they will make any money. By the time that land is transferred to an heir at death it likely will have increased greatly in value, and under President Biden’s plan this would trigger a significant tax burden for the person who inherits it.

I experienced this firsthand when my dad died in an accident on our family farm and ranch. Our family was dealing with a tragedy, and suddenly we were faced with a massive death tax bill. We had land, machinery, and cattle, but we didn’t have any money in the bank. Thankfully, we had support from our small community and were able to borrow on our land and pay off that debt. But it took ten years and a lot of sacrifice. Those less fortunate than us would have been forced to sell the family farm to pay that tax.

That’s why I got into politics in the first place. And when I was in Congress, I worked with President Trump to repeal the death tax for most family farms in the Tax Cuts and Jobs Act.

Our farmers and ranchers face challenges every day that few of us can imagine. They work and sacrifice to feed the world while building something that they can pass on to their kids and grandkids. Another death tax will only make it more difficult for young farmers and ranchers to acquire the land and equipment needed to pursue a life in agriculture. As a result, we will see more farm consolidation and the loss of vibrant rural communities.

Prosperity is not created by higher taxes and bigger government. Leaders like Ronald Reagan and Donald Trump knew that. The American people create our shared prosperity through their independence, hard work, and ingenuity. Washington, D.C. should learn to leave that well enough alone.

###

Oh how I wish the governor had the same concern for hourly and salaried people. They can’t avoid/delay income taxes like the wealthy.

Kristi would have the children of billionaires pay nothing when they receive their unearned bonanza… while the rest of us pay Uncle Sam out of our meager, hard-earned income. The Waltons, Gates and Hiltons have it so hard, you know.

But we’ll pretend it’s for the farmers. That sounds better.

Noem says: “Farmers and ranchers tend to own large amounts of valuable land, equipment, and livestock that makes them appear wealthy on paper…”

Uh. OK. Let’s look at that for a second. They own large amounts of valuable land, equipment and livestock but they only “appear” wealthy? Hey, I was raised on a family farm. I get it… but we need a level playing field. Many of today’s farmers are exactly as they appear. Wealthy.

If they don’t pay taxes, who does? And if the billionaires don’t pay, who does? Are you going to shift the burden to the average income folks living in Watertown, Aberdeen and Sioux Falls?

But, she says it’s for the farmers and ranchers, you know. The rest of us can just keep paying the taxes so the rich don’t have to… and keep quiet. We need to do this… you know… for the farmers.

Farmers and ranchers pay income tax like everyone else. They build their equity with after tax money. Farmland is not depreciable so they cannot use it to avoid taxes.

Not true. Farmland appreciates, and never has to be replaced (unlike depreciable assets) and this appreciation is the farmers greatest source of income and wealth and is never taxed if never sold.

It is currently taxed under the death tax even if not sold.

But there is no death tax. So currently it is not taxed.

Sorry but that is not correct information.

The solution might be to give each of your children $15,000 worth of shares (pieces of paper) in your family farm every year until you die because you can’t inherit what you already own, and hope that they never file for bankruptcy.

And leave the farm to your spouse so when you die no tax is owed. Defer the tax, don’t give some of it to your brothers making an estate taxable that didn’t need to be. Weird I know.

A lot of armchair tax attorneys on the war college…

another way to save money is to skip a generation in the will. It’s one of the ways the super rich stay rich and it’s not as messy as marrying your cousin. Leave your estate to your grandchildren.

Personally, in general, I prefer a lowering of the income tax rate/capital gains rate and having an inheritance tax. I’m ok with transferring the taxes to heirs vs. the people who made the wealth.

Regarding farmers and ranchers, I can support the concept of an exemption/deferral to heirs who live and continue to work the farm. An heir who has moved to California and is now just a landlord in SD, tax the inheritance (with a tax credit if the land is sold to a sibling who stays on the farm).

SD is becoming a state where increasing amounts of our land are owned by people whose only connection to SD is that land and might not been here for 20 years.