If you blink, you might miss it. But State Representative Aaron Aylward is proposing a brand new tax through removal of an exemption that has long stood in South Dakota, and despite multiple attempts which have consistently been ground to dust in the process.

The proposal, being brought forward by Representatives Aylward (prime), Baxter, and Jensen (Phil) and Senator Taffy Howard quietly draw a line through one word in South Dakota Law, without giving a hint as to what they’re doing in the title. Because in the past they know prior efforts to remove the exemption drew the ire of all of South Dakota’s business organizations as well as the media.

As led by Aylward, He, Baxter, Phil Jensen and Taffy Howard are very quietly leading a campaign to create new taxes in South Dakota – the kind that they probably don’t want people talking very loudly about. As noted in House Bill 1138:

Section 2. That § 10-45-12.1 be AMENDED:

10-45-12.1. The following services enumerated in the Standard Industrial Classification Manual, 1987, as prepared by the Statistical Policy Division of the Office of Management and Budget, Office of the President are exempt from the provisions of this chapter: health

..

(30) Rentals of motor vehicles, as defined by § 32-5-1, leased under a single contract for more than twenty‑eight days; advertising services; services

Read that entire bill and look very carefully here.

You’ll have to read it 3 or 4 times, but hidden in the re-write of the sales tax exemption statute 10-45-12.1 two simple words are being taken out. via the overstrike Aylward and crew are proposing to remove the sales tax exemption on advertising.

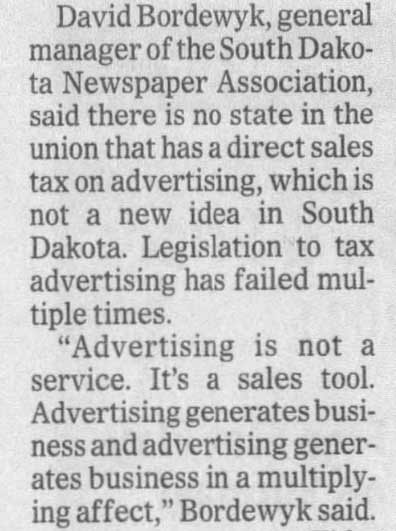

Why has this long been sacrosanct in state law? In the words of South Dakota Newspaper Association Director Dave Bordewyk, testifying against a similar proposal back in 2011 noted:

In other words, it’s not a service and can be challenging to call it a product as much as it is a method of communication connected with the sale of the product .. kind of like taxing the string in the hay bale. You can sell the hay without it, but it’s more challenging to do so, and you aren’t going to do as well at the final sale price.

I believe one of the last attempts to do so was in 2020, where State Representative Caleb Finck brought a measure as part of House Bill 1284, where in a hearing held

2/20/20 the provision was struck from 2020 tax bill.

Interestingly, the bill was not sent to the House Taxation committee, but they put it over to House State Affairs for review. While it’s not on the schedule just yet, keep an eye out for it on the agenda.

You can reach out to the committee members through the links below (click on each one individually for their e-mail and phone):

Bahmuller, Jessica (R);

Emery, Eric (D);

Gosch, Spencer (R);

Hansen, Jon (R);

Healy, Erin (D);

Heinemann, Leslie (R);

Jamison, Greg (R);

Lems, Karla (R);

Odenbach, Scott (R);

Overweg, Marty (R);

Reisch, Tim (R);

Schaefbauer, Brandei (R);

Soye, Bethany (R)

You can let them know Yes, New Taxes, if you are in favor of new taxes, or if you want to inform them NO NEW TAXES.

No new tax unless it includes all campaign advertising, donations, PACs, etc.

the logic against any advertising tax is valid.

advertising is a business expense. those who sell the advertising already pay taxes on the money they make from selling the ads. if the media outlet is forced to raise prices because they have to pay a new tax on the service (which earns them already taxable income) – THE ADDED EXPENSE IS ALWAYS SHOVED BACK ON THE CUSTOMER – i.e. average citizen. the level of stupid in government usually crests and falls again at this point but hey go ahead and create this magic double tax on people and see if new magic happens or the same old inflation happens.

No wonder Hansen sent the bill to this committee. It is loaded with his fellow whackadoodles. Reisch is the lone sane person there

I have never understood why advertising isn’t taxed…everything else is.