From Twitter, Rep. Tony Venhuizen and Sen. Randy Deibert explain their proposal for property tax relief:

I hear more about property taxes from my constituents than any other issue, by far. This is the year for major property tax relief for South Dakotans.

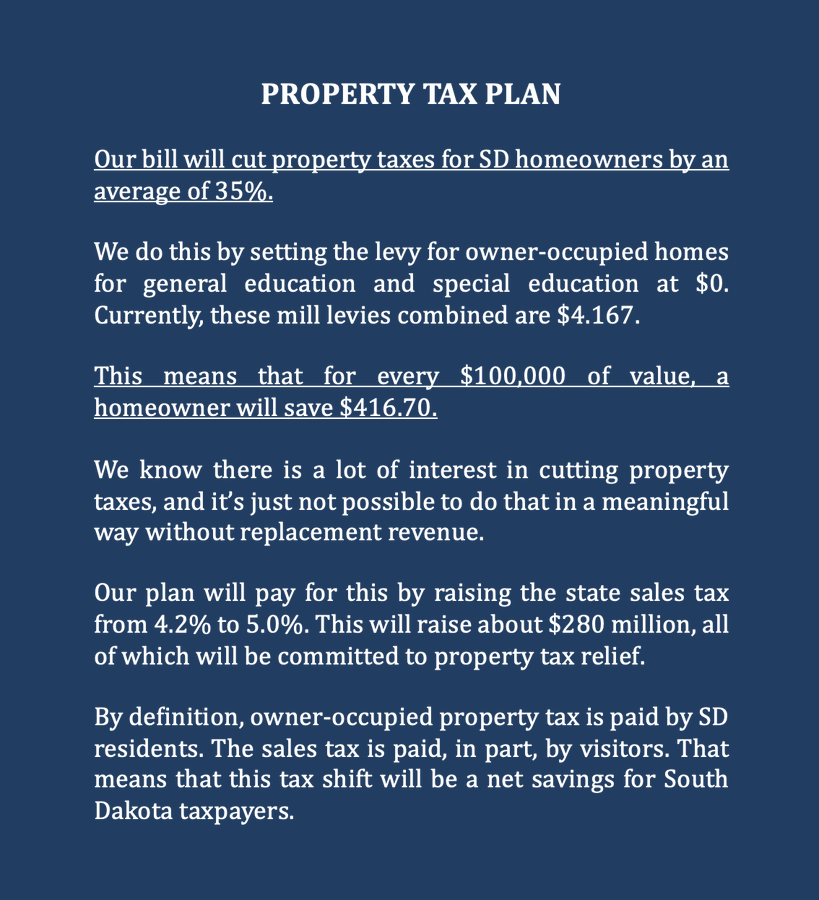

This coming session, I am sponsoring legislation to cut property taxes for homeowners by an average of 35%.

Sen. Randy Deibert… pic.twitter.com/oWIUYXmbx2

— Tony Venhuizen (@Tony_Venhuizen) December 5, 2024

I’m all about cutting taxes, BUT our state is funded by sales tax and our schools are funded by property tax. Where will this cut be shifted? Or how will those funds be replaced?

I’m all about trimming budgets as well, BUT if the budget is cut our schools will suffer.

My guess is the tax will be shifted from homeowners to landowners and commercial property.

The proposal raises Sales Tax to 5% and that increase will be used to supplement the aid formula.

Rep. Tony Venhuizen and Sen. Randy Deibert propose sales tax increase

Lower taxes for owner-occupied homes, increase them for any home owned by a non-person entity, scaling with the number of homes the entity (or the entity’s beneficial owners) own.

Won’t this differential be passed onto renters, who might least be able to bear an increase?

Farmers and Ranchers will bear the brunt of the sales tax increase.

And those who own rental properties etc ultimately that cost gets passed on to renters. Not a real cut at the end of the day.

Mayhaps the scale would be adjusted so that any entity directly or indirectly owning more than a handful of single family homes would be economically impractical, forcing them to sell it.

Anonymous at 1:10PM: This would just create a major problem with shell corporations and/or people creating a new business entity for each building, only slightly adjusting the name. Also, how do you count? Do multiple 600 squarefeet apartments multiply more than one 2400 squarefoot house?

Anonymous at 1:13 PM: I cannot imagine that this would not be shifted onto renters.

Anonymous at 1:53 PM: Scale of the corporation is not necessarily the problem. Large companies can be and sometimes are perfectly fine landlords. You also still have the shell corporation issue; investigating shell corporations would become a key function of the tax office. All of this costs money for the tax office and the corporations.

The big problem here is that home owners and businesses that own their own buildings already have systemic advantages over renters and any push to tax rental properties at higher rates only contributes to the problem.

Perhaps then it’s time to tear down shell corporations. What good have they ever served except to obfuscate and hide bad actors.

Unless you can say that sales tax money is going to be allocated for General Education, and Special Education… it really is not a benefit to anyone in the long run. South Dakota already suffers in the Special Education department, let’s not set us up to be even further behind other states.

The last time we raised the sales tax for education the State took 40% for other areas. I hoped they do not do that again. The details are always in the fine print.

What a monumentally bad idea to jack up the state sales tax rate by 20% after both party’s gubernatorial candidates campaigned on eliminating the grocery tax. Now were going to put another 20% premium on that tax?

The people of the state voted against it, so let’s give them what they want, more taxes on sales!

It is always healthy to occasionally discuss and review if the tax burden is properly balanced between property and sales taxes.

And it is also acceptable if we reach the conclusion we have a good balance.

Don’t forget the Republican legislators and governor increased what you pay when they extended sales tax to online purchases They forget their promise to do a tax cut if online purchases were taxed.

Property taxes must be cut but this is just a shift and not a reduction in spending and taxes. .

We really need to address the lack of home ownership because everyone wants to be a landlord. The American dream is built on the concept of owning a home and passing on that equity if it isn’t used in old age. That is being lost and it needs to be addressed.

I hate the general idea of paying tax on property you already own. And I would prefer to pay more sales tax than property tax. However, this idea is flawed. We will experience a small property tax cut, but within a few years school and county governments will drive up assessments and levies and opt outs, knowing they have some room to do so. So we’ll end up paying 20% more in sales tax, and our property taxes will be back to current levels in no time.

That is already happening.

This is a good idea. The Dems won’t like it, but this is huge for homeowners. Good job, Mr. Tony.

Good idea to help South Dakotans.

Isn’t this ironic. If instead of this we eliminated tax on food, the average savings to every household would be about $400 to every family. BUT WE DONT WANT TO HELP THOSE LAZY DIRTY POOR WHO CANT AFFORD A HOME! This way we don’t do anything for them and that is what we want, right?

Culture war bills are easy distractions so that the session will end quickly and we can call it a success!

property values have skyrocketed coming right behind the installation of all that 5G cable. Having reliable internet in a state with few covid restrictions and no state income tax attracted newcomers looking for a good place to work from home, and they started showing up and buying houses.

Blame it all on 5G. You have 5G now so your house is worth more, and your property taxes are going up.

The 5G Conspiracy kooks missed the real threat, and instead warned us that 5G radiation would give us cancer, scramble our brains, allow the government to keep us under stricter surveillance, it could be used for crowd dispersal, all kinds of sinister outcomes.

They missed the REAL threat, higher property taxes!

5G will change your gender, watch out

absolutely. maybe we should fund the excavations to pull all that cable out

The real property tax imbalance in SD is the one between ag property (income generator) and owner occupied (non-income generator), No one wants to grapple with that 800 pounder.