Protecting Taxpayers From Outdated and Expensive Pandemic Policies

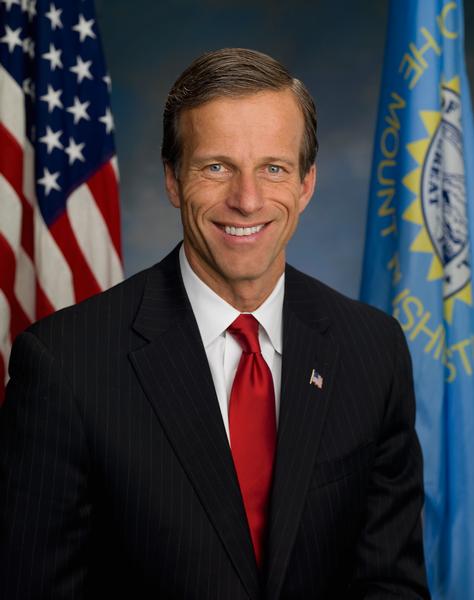

By Sen. John Thune

On the 2020 presidential campaign trail, President Biden painted himself as a left-leaning moderate. However, since taking office, he has prioritized policies to appease the far-left wing of the Democrat Party. Here’s what those policies have gotten us: an inflation crises, an energy crisis, and a southern border crisis. Unfortunately, there’s no sign the president or the tail that’s been wagging the dog has any desire to shift course. For example, look no further than the latest Democrat push to cancel student loan debt.

For years, progressive Democrats have talked about cancelling student loan debt – as if the federal government were able to draw from an unlimited pot of money – and now, they are trying to use COVID-19 as the catalyst to get there. Recently, the president announced that he is extending the moratorium on federal student loan repayments, the accrual of interest, and debt collections for another four months. In the early days of the pandemic, this made more sense as a temporary measure for a genuine emergency as Americans’ jobs were in jeopardy as the economy quickly began to shut down. But it’s been more than two years since the pandemic began, we no longer have double-digit unemployment, and most folks are back to work. In fact, in South Dakota, our unemployment rate is a low 2.5 percent.

Deferring student loan repayments has already cost the federal government more than $100 billion, which is why I recently introduced the Stop Reckless Student Loan Actions Act. This common-sense legislation would protect taxpayers and block President Biden from endlessly deferring federal student loan repayments. It would also prevent him from using the pandemic – or future national emergencies – as a reason to cancel these student loans outright. To put it simply, South Dakota taxpayers and working families should not be responsible for continuing to bear the costs associated with President Biden’s outdated, budget-busting student loan repayment moratorium, especially since many of the borrowers who’d be on the receiving end have a high earning potential.

President Biden’s press secretary, when referring to the repayment deferment, recently said that “between now and August 31, it’s either going to be extended again or we’re going to make a decision about canceling student debt.” This statement, coming directly from the president’s spokeswoman, makes it alarmingly clear that these repeated deferrals aren’t temporary relief measures. They’re meant to buy time while the president figures out how he can cancel a significant portion of federal student loan debt – money that borrowers agreed to pay back.

Contrary to the radical left’s view, cancelling student loan debt won’t magically solve every problem. It would do absolutely nothing to address the root cause of student debt – the rising cost of higher education. Also, from a fairness perspective, why should the federal government force Americans who incurred no college debt to shoulder the bill for those who did – especially when a substantial portion of that debt is incurred by those with the greatest earning potential like doctors and lawyers. And beyond that, what about the Americans who worked hard for years to pay off their loans? Or, what about parents who have sacrificed and set aside money in order to send their kid to college?

I supported providing temporary relief when it was really needed, but the continuation of student loan deferment or any type of student loan cancellation is a terrible policy at this point. I am doing everything in my power to end President Biden’s unnecessary and outdated student loan deferment and prevent him from perusing his radical wish list at the expense of hard-earned taxpayer dollars.

###

John doesn’t realize that republican’s have student debt too, but nice attempt at saying this is all the “radical liberals” again. The reason deferment cost the government $100B is because you are gouging us on interest rates. Rates for graduate loans range from 9%-6.5%, at $200K a degree (apparently John doesn’t have a concern with capping what the government will loan out and slowing tuition growth), that results in needing a salary of about $330K a year to pay back one’s loan in the 10 year plan. Sure, we have 2.5% unemployment, but how many of those jobs are paying $300k+/yr? I’ll fill you in on the answer, zero!

Let’s say you land a good job, maybe $150k a year, unless you can drop $3k a month towards your loan, you go on income based repayment over 25 years. That is enough to keep giving John and his donor’s money, while they created a great generational tax bracket of an additional 10% on us. After 25 years, it is forgiven (which happens to be nearly the full principal unless you get a giant raise), and we are in the same situation John is whining about here.

This is the Boomer generation folks, the greatest generation has to be shaking their heads at their spoiled kids trying to pass the buck to their offspring. While their parents tried to create something great for their kids, these boomers are trying to make it easier for only them. You can’t take your money with you when you die, how about solve the problem (quit spending money, or raise more money outside the college graduate bracket) instead of this name calling and whining. ** Drop interest rates to near zero, put a cap on what the government will give students to attend schools. This will reduce tuition at some institutions, and encourage more people to go to trades schools which are more in need now anyway. **