It’s an Emergency

By Rep. Dusty Johnson

January 5, 2024

BIG Update

For years, there has been public concern about members of Congress buying and trading individual stocks while they’re in Congress due to their authority to regulate corporations and access to confidential information. We can mitigate this concern and protect public trust in our institutions by prohibiting members of Congress and their families from trading individual stocks.

I’ve long been a supporter of the TRUST in Congress Act to require Members of Congress and their families to place their investments, like individual stocks, in a blind trust during their tenure in Congress. Members of Congress should be held to a high ethical standard, and they shouldn’t be able to use confidential information for personal gain.

BIG Idea

This week, I had the honor of shadowing Dr. Eide at Monument Health’s Rapid City Emergency Department. While this is the busiest emergency department in all of South Dakota, North Dakota, and Wyoming, Dr. Eide and the healthcare professionals remain composed and compassionate with every patient.

Dr. Eide taught me more about our healthcare system in that short time than I could have dreamed possible, all while providing exceptional care to patients with a variety of complex medical needs. Thank you to Dr. Eide, his coworkers, Monument Health, and the patients who allowed me to observe their care.

I’m grateful for the valuable insight Dr. Eide provided on how emergency departments manage triage, deal with paperwork and records, handle workplace violence, and work for better health outcomes.

BIG News

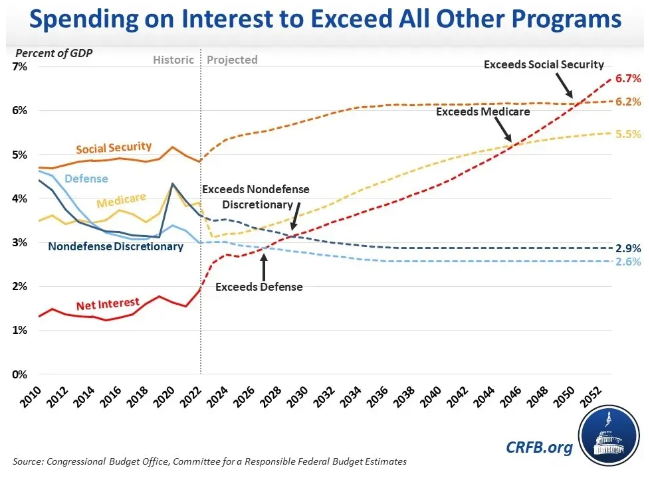

It’s an emergency – this week, our national debt topped $34 trillion. Earlier this year, the Congressional Budget Office projected that debt to keep growing, but not slowly. Over the next ten years, we can expect the national debt to grow by $22.1 trillion. With high interest rates, the amount of interest paid on the national debt is skyrocketing. By 2027, these interest payments will be more than our defense spending. And by 2051, interest payments will be the highest government expenditure, forcing the federal government to divert money away from other government functions, like the VA and our military, just to pay our bills.

I’ve opposed $13 trillion in reckless spending by President Biden and Congressional Democrats, but there is more work to be done. These numbers prove our nation’s fiscal habits are reckless and out of control. I’ll continue to make fiscal responsibility a top priority in 2024.

good work sir, thanks. REALLY LIKING the “trust” act idea, gotta say it.

A very interesting chart and the sky is not exactly falling. We’re basically borrowing money (basically from ourselves) to invest in infrastructure, our health and welfare, and our national defense. We are betting that our economy will grow faster than our indebtedness Under Representative Johnson’s prediction our expenses level out in 2040 though our debt payment (which we’re paying to those of us who are bond holders, as well as investors around the world who have chosen to buy our bonds. Of course, long term, this is unpredictable, but, up to this point, American bonds are the best long term investment in the world.

Thune, rounds, and Johnson voted for the debt ceiling raising bill. That is not consistent with their comments that debt is a problem.

the budget bills and debt ceiling bills are separate issues, you know that, right? conflating them isn’t helpful to either problem. it only helps an emotion-based brand of angry mob politics to fester.

I disagree budget bills and the debt ceiling are the same issue. Debt ceiling puts a limit on the budget bills and therefore spending. As far as bonds their face value is the same as 2020 but the US dollars you get back from them are worth 20% less since 2020 due to inflation and cost of living increases that are due in a large part from US government spending (US debt).