South Dakota Redistricting – An Every Ten Year Dance

South Dakota Redistricting – An Every Ten Year Dance

by Senator Lee Schoenbeck, Senate President Pro Tempore

Across America states are beginning the decennial project of redrawing their legislative districts, a Constitutional obligation to ensure that every citizen’s vote has equal weight in the legislature by equalizing the populations in districts. The population numbers come from the census every ten years. Thursday afternoon South Dakota legislators received the new county population numbers. So, Thursday night I sat down with a calculator and a map, and drafted a first look at how to fairly divide our state into 35 legislative districts of roughly equal population, that are compact and reflect communities of interest. This article describes that process, a process that will go on until the special session of the legislature finalizes a map on November 8 and 9; or fails to, and the Supreme Court does it the next month.

MATH

Assuming South Dakota stays with 35 legislative districts (we don’t have to), and knowing that the population is 886,655, then the sweet number per district is 25,333. There is a 5% tolerance higher and lower (10% between the largest and smallest) that generally makes the range from 24,066 to 26,600.

LIMITATIONS

When you’re doing this jigsaw, it’s good to start in a corner. You can’t use any of North Dakota, Minnesota, Iowa, Nebraska, Wyoming or Montana that adjoins us, and you can’t give them any of ours that doesn’t fit quite right. You have to make the pieces fit.

COMMUNITY INTEGRITY

Districts that most reflect communities of interest are generally preferred. Legislators will be better able to represent the community, and the community is more likely to know the legislators and candidates that are closest to them. Keeping districts compact is obviously important to achieve that goal.

Outside of our largest cities, citizens don’t know their legislative districts by the number assigned. They know what county group they are usually a part of. If you doubt that, walk down Main Street in De Smet or Eureka or Faith and ask the first twenty people you see: “what number is your legislative district?”. People identify along county lines in rural South Dakota. In Sioux Falls and Rapid City you can’t do that for their many districts, so they are unique and neighborhood line drawing is a different animal.

Tribal communities have historically been grouped together as communities of interest. The Voting Rights Act used to require federal approval that impacted those lines. Now, it’s a recognized guiding principle in drawing boundaries, even if not as substantive of a legal requirement.

SHOEHORNING

The counties won’t fit exactly into the population requirements, because the counties were mostly drawn in the 1890s and the population numbers were released in 2021. So, you do your best to keep them mostly intact. Around the edges, you need to shoehorn a little. For readers under 35, that’s a little device you used to use to snuggle your heel into a good leather dress shoe (when they made those back in the day). In the redistricting context, I use it to describe the precincts around the edges that you need to move into an adjoining county to shoehorn a district into the population constraints. This has always happened.

INFORMATION NOT AVAILABLE YET

The precinct-by-precinct numbers are not available yet in usable format for the legislators. They will be soon. This map recognizes the limits that the lack of current information imposes. Facts matter, and as those numbers are available, gaps in this map can be improved, and the Rapid City, Minnehaha/Moody/Lincoln, and other divided counties can be fleshed out.

CONURBATION DISTRICT

This is a word you’ll hear in redistricting to mean an area that multiple districts will be drawn from. In South Dakota, that would apply in the Sioux Falls and Rapid City areas. The thing to remember about that fancy word is that it is a useful concept, but it can interfere with good redistricting. It creates new borders. If those are viewed as rigid borders, boundaries can suffer when you need to do a little “shoehorning”.

SO GETTING STARTED

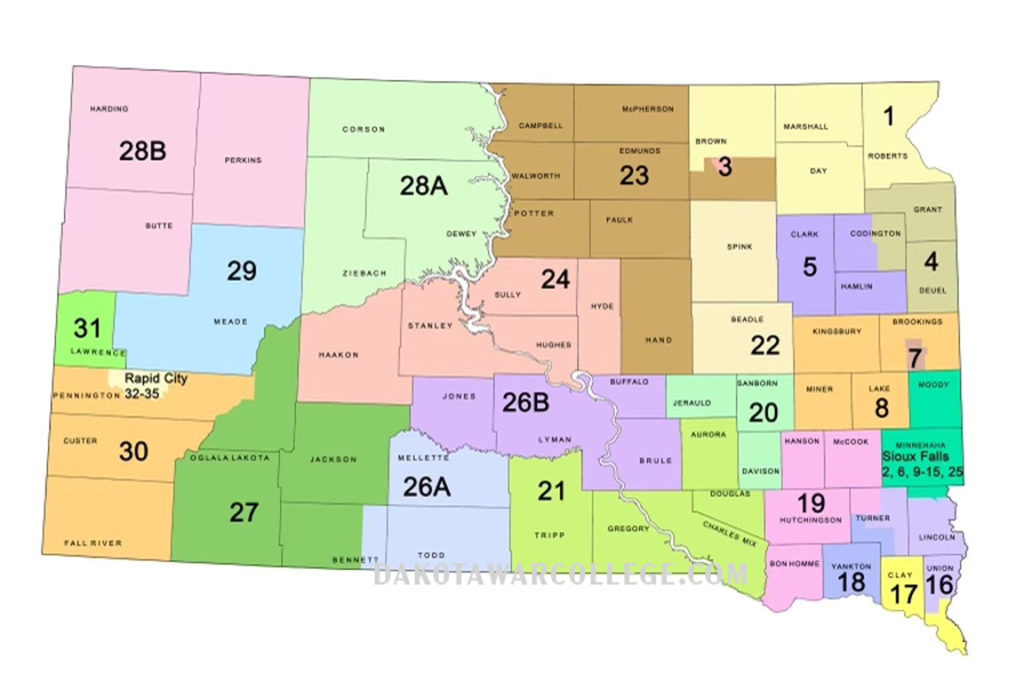

Here’s a first draft, because every process has to start somewhere, that I have provided to the senators and the public, to begin the discussion. Both the House and Senate have redistricting committees that will be holding hearings across the state for input. Ultimately, they will make recommendations to their bodies for the special session. But, you need something on the canvas to begin – a starting point. This is one option. For people to comment on redistricting, they need to know that every time you push a line somewhere, it causes a bulge somewhere else. Every action has an equal and opposite reaction (who knew physics had application to politics). You can’t look at one line or county or district in a vacuum and you need to look at what matters for the state or region as a whole. No district should be about protecting or promoting an individual candidate.

A MAP – not THE MAP

DISTRICT 1: Roberts, Day, Marshall and part of Brown Counties

You need to start in a corner, and Minnesota and North Dakota work just fine for Northeast South Dakota’s District 1. The three whole counties that have always been the core of District One make up the Coteau des Prairie and are home to the Sisseton-Whapeton Oyate. Their population is 20,035. They currently also have part of Brown County. They will need to take about 6,500 Brown County voters. The committee would need the precinct data to draw that line

DISTRICT 2: gone

As a result of population growth in Minnehaha-Lincoln , at least one full district in the rest of the state has to disappear. This was the most unusual, elongated, not sustainable district that went from Aberdeen to Lake Poinsett. Its parts would now be needed to fill out three other adjoining districts.

DISTRICT 3: Aberdeen

The committee would need to use precinct data to make an Aberdeen district. Brown County has 38,301 people. They can keep 26,600 in Aberdeen, and that leaves 11,701 to share with Districts 1 and 23.

DISTRICT 4: Grant, Deuel, and Eastern Codington

When District 2 was created ten years ago, it necessitated drawing a long, unusual District 4. It’s two hours across (in our populated I-29 corridor!) and legislators and constituents drive through two other districts to cross it! The proposed new map would put all citizens within an hour of their legislators – most, a lot closer. Grant and Deuel have 11,851 people and would take half of Codington County and Watertown to fill out their district. The district would match up with school boundaries, and employment and shopping patterns

DISTRICT 5: Clark, Hamlin and Western Codington

Clark and Hamlin have 10,001 citizens and the west half of Watertown and Codington County would make exactly a district. Even more than District 4, the employment and commercial interrelationship of this area is substantial. The only odd thing is that this author would be giving up his biggest Republican precinct and sticking himself in a new district! The current District 5 is inexcusable. A compact district that is 15 minutes across, forces adjoining districts to be very large to find enough population. Its easy for legislators and bad for citizens and public policy.

DISTRICT 6: gone

Not really – its very much intact, see below. But the numbers have to be changed. It won’t be #6, that was kind of a lazy numbering handover from the last redistricting.

DISTRICT 7: Brookings and Medary Township

This district would take 26,600 of Brookings County and the balance would go to District 8. Brookings County has 34,375 people, so 7,775 extra in rural Brookings County.

DISTRICT 8: Lake, Miner, Kingsbury and Rural Brookings

Kingsbury, Lake and Miner have 18,544, and with the 7,775 of rural Brookings County there would be a district of 26,319. This is a geographically compact and economically interlinked area.

—–TIME OUT —–

Remember, when you push one place, it pops somewhere else. South Dakota’s growth is largely in the Southeast and thus the rubber match is there. To logically follow that process, now go back to the north center of the state. District numbers can change, but the map works generally with current numbers and areas.

DISTRICT 23: Campbell, Walworth, McPherson, Edmunds, Potter, Hand, Faulk, and part of Brown

The German Russians up there aren’t procreating fast enough. This is a demographically older district that has lost population at a significant rate. They need more real estate. The part of Brown County that remains from old District 2, fills that gap. They go from 20,831 to a right sized number. They do lose the shoehorned precincts from Spink that they had from the last redistricting.

DISTRICT 22: Beadle and Spink

This is a Jim River valley district with a strong community of interest, where two complete counties have a population of 25,510 (sweet spot)

DISTRICT 24: Hughes, Hyde, Sully, Stanley and Haakon

This district needed more real estate, and has limited options. Adding Haakon puts it at 25,325 (sweet spot). Stanley and Haakon are a strong community of interest as ranch country – that does business in Hughes County.

DISTRICT 28: Corson, Dewey, Butte, Perkins, Ziebach and Harding

This map covers the Standing Rock and Cheyenne River reservations and unites all of Butte County in one district. It’s a big real estate eater that would be bigger without all of Belle Fourche. 25,943 (sweet spot)

DISTRICT 29: Meade (partial)

Meade County is now 29,852 and needs to lose approximately 4,000 citizens, and it has historically contributed to the Rapid City districts. So, this district can’t have the shoehorn part of Butte it used to have and would most logically shed those extra citizens to Rapid City in the I-90 area that is really part of the Rapid City trade/employment area.

DISTRICT 31: Lawrence

Once again, this Northern Hills county embodies perfection, weighing in at 25,768 South Dakotans (sweet spot).

DISTRICT 30: Fall River, Custer, and western/southern Pennington

Fall River and Custer are at 15,291 and would need 10,000 Pennington County citizens from the western and southern parts presumably. They likely would no longer need eastern Pennington County.

—-TIME OUT #2—-

To finish the map West River, its necessary to jump back east a little and see what challenges are caused by the two districts tied to reservations. Both districts did not grow enough to maintain their current boundaries (too small).

DISTRICT 26: Todd, Mellette, Jones, Lyman, Brule, Buffalo, and eastern Bennett

The old district only has 23,067, and so it needs to add 1,000 people. By taking those from eastern Bennett the district maintains in demographic makeup. The other option is to move Tripp County west and sit back and enjoy the federal litigation.

DISTRICT 27: Oglala Lakota, Jackson, and most of Bennett and eastern Pennington

Oglala Lakota, Jackson and the rest of Bennett has a population of 18,859. It would need to replace the Haakon County loss, and eastern Pennington would be of similar demographics and border the northern edge of the Pine Ridge reservation. They would need 5,200 voters from eastern Pennington County. The part of Pennington would go west to somewhere near New Underwood.

DISTRICT 32-25: Conurbation #1

The four Rapid City districts (#30 may well have some of southern Rapid) would have 99,200 voters to divide up. They would also have the SW corner of Meade referred to above.

DISTRICT 21: Tripp, Gregory, Charles Mix, Douglas, Aurora

These five counties have a population of 24,573. The district needed to grow and realistic had to take Aurora County, to keep counties whole

DISTRICT 20: Jerauld, Sanborn and Davison

These three counties have a population of 23,949 and would need to pick up 100 people (remember the shoehorn) from an adjoining county. Jerauld and Davison are already together, and in the past Sanborn has been in that district.

DISTRICT 18: Yankton and SW Turner

Yankton County can no longer stand alone, it didn’t grow enough to keep up with the minimum necessary. Without making a mess of District 19, or unnecessarily breaking up Clay County, Yankton’s 23,310 would need to be supplemented with 750 voters from SW Turner County.

DISTRICT 19: Bon Homme, Hutchinson, Hanson, McCook and NW Turner County

The four complete counties would have 23,573 and need an additional 500 citizens from NW Turner County. This keeps a long-standing district in place, and avoids the political carving that it has frequently seen over the last few rounds.

DISTRICT 17: Clay and Southern Union

Clay County has 14,965 and would need 9,100 from southern Union County, or about 54%. These two counties were historically joined. The Dakota Dunes community would have strong business, social and cultural ties with the University in Vermillion.

DISTRICT 16: Northern Union, Southern Lincoln and Eastern Turner

This district is a compact community of interest with 1-29 through the middle, the easiest rural district to campaign in (nobody gets an interstate!). Union contributes 7,711 up to south Beresford. Turner contributes Parker and 7,423. Lincoln, from North Beresford up to and including Canton would contribute 11,000.

In this district you can see where the growth area starts to form a push-in and pop-out syndrome. The current district is socially identical to the new one, absent the Dakota Dunes area, which changes makes the district more cohesive.

CONURBATION #2: Northern Lincoln, Moody and Minnehaha – 10 districts

Lincoln would contribute 54,161. Moody 6336. Minnehaha 257, 711. The average is 25,711 – or as they say in this business – the SWEET SPOT

This mechanic’s kid doesn’t know enough about the neighborhoods in the conurbation areas to opine on what’s a right or wrong line, except in two broad strokes outside of Sioux Falls.

The current Lincoln County district that is Tea area to Springdale Township has more than enough voters to exist in Lincoln County on the southern part of the area, and Lincoln County would still contribute over 28,000 to the Minnehaha County districts. This District was numbered 6, but needs a new number.

The “Northern” Minnehaha districts ten years ago were an abomination driven entirely by an effort to create districts for individuals – really bad public policy. The Dell Rapids district, if drawn on a map by a sober third grader, would never touch Iowa or circle south of Sioux Falls! The current one does! The new conurbation area creates the opportunity for a district around an established community of interest (school districts, sporting events, community celebrations and work patterns) with Moody and northern Minnehaha counties – the Dell Rapids, Flandreau, Tri-Valley area.

CONCLUSION

No one person will draw a perfect map on every point for South Dakota. This mechanic’s kid certainly isn’t claiming to get there. But, for the largest part of the state, any dozen people that weren’t selling some unique agenda, who wanted compact districts that reflected communities of interest, would end up pretty close to this one – other than in the conurbation areas.

Let the mud wrestling begin.

Looks like a pretty good map. Only splits three small counties. Compact geographic regions. Fair to Dems etc. good job Schoenbeck.

Good job Senator. Looks like a good map. I like Dakota Dunes going in with Vermillion. No weird shapes. Only a few splitup counties. Good work.

Thanks for being transparent

Conurbation #1 will have those insaner than most in the District numbered #30 all up in arms. This will be ugly along the battle lines in Colonial Pine Hills.

Didn’t want to be on redistricting committee . Now wants to be transparent in pushing his personal preferences out.

You know how you can solve “your problem”. Get your name on a ballot, run a campaign then win. Oh yeah then you have to gain respect, represent your whole district, leave your family for a considerable time, get paid horribly, take phone calls all the time, defend all your votes and put up with silly clowns who write pointless blog posts.

Good map Senator Schoenbeck. No strange looking districts. Seems like communities of interest. Only a few counties split (except the big ones that have to be). Doesn’t seem like many unnecessary primaries created.

Three comments:

1). Lee puts his name on his thoughts. It shows his shoulders are big enough to handle other ideas and his back smooth enough to handle the petty to roll down to the ground with nary a concern.

2). It has sufficient description of his rationale and detail to be discussed on its merits (as opposed to the slur by the guy at 9:20 whose only comment is personal and not on the substance of what he has laid out).

3). The best way to expose the “termites” is tear off the sheetrock. Lee has brought into the discussion in the light so we can have confidence in the result.

A place to start but by no means a final product New proposals will be out by Labor Day or before. I agree with some of these revised districts but disagree on others, along with the explanations. One thing I do agree with is that we need a revised numbering system that follows a logical geographical progression. It will be an interesting 80 days or so until the special session. JB

Glad we know Jim Bolin agrees with some and disagrees with others. I can sleep easier with this knowledge.

Is he still in the legislature?

Jim, you figure out the numbering.

A couple of questions:

1. Right now we have 35 districts, Are there any thoughts about adding two or three more districts? I know there are pros and cons. Just, is this a possibility?

2. How often do counties redraw voting precincts? I know in drawing districts you have to include entire voting precincts. How does this affect the drawing of districts?

MC,

1) Only four states in the nation have legislative districts with less people than us. Instead of more legislative districts, a stronger case can be made for fewer.

2) I don’t know the answer to this. Good question.

District 2 Kaleb Weis would be removed which would be good but sad to lose that district.

Very interesting Lee. Looks like a b bucket full of calorie burning work.

MC – The South Dakota constitution says no less than 25 districts and no more than 35. We are at the maximum right now and have been for at least the last 50 years. JB

It’s a thought, and I appreciate Lee putting it forward. I’d like to see what other committee members bring forward too. My biggest concern with Lee’s proposed model is the unnecessary loss of rural representation. While the population is obviously shifting toward urban areas, the proposed model seems to unnecessarily provide more urban representation and less rural representation than it is necessary

Rural loss of representation is due to fewer people living in rural areas. 1 person 1 vote Fred.

A bit of trivia or history depending on perspective…hope I have it right. Norbe Barrie, Turton, now deceased, had observed the proposed tentative maps drawn 10 years ago and commented to apparently the right person that the “ag” vote was not well if at all represented….because every district had a population center in it that drowned out the ag numbers. That discussion is credited for the redrawing of District 2 at that time…as it snaked between population centers to preserve an “ag” representation. I believe other lines were also modified to give the farmers at least a couple legislators who would represent their interests. I doubt anyone can deny there also were several incumbent legislators at that time who were jerrymandered for, to ensure their likely election retention…on both sides of the aisle.

Personally, in 2010 my location and 5 other townships were carved out of Spink Co (where I am county chair) into Dist 23, apparently to build 23 up to enough to fit in the parameters. Geographically, I live closer to Sioux Falls than Pollock on the other end of Dist 23. The sparsely populated regions do not easily fit the county maps, and trade areas do not necessarily either.

I don’t know what is best, but having separate legislators that answer primarily to the diverse interests of the state…agriculture, tourism, ethnicity, and yes urban issues to me makes a better body to address the issues…sometimes squaring up a map makes sense, sometimes the best path is a straight line, but sometimes going around the mountain makes more sense.

Larry Nielson, Spink Co Chair

Another issue relevant to the discussion is legislative process. 10 years ago when this was last accomplished, the legislature established a single committee to develop recommendations. The committee was composed of both Senate and House members. However, this year, there are two separate committees. One committee consists of house members and the other consists of Senate members. If the goal is to develop a single map, it would be helpful to describe the means that the two committees will collaborate to accomplish this.

Nobody likes Lee as much as Lee likes Lee.

One reason there is little rural representation is very few farmers think they have the time to spend in Pierre. My district 04 is very much an ag district yet none of the legislators representing it are farmers. I often asked farmers from both parties to run for office with little success. When the legislature raised taxes farmers where hit very hard. Truck lis went up to 80% of commercial even though most have annual mileage of ten percent of commercial. Farm machinery went from 3% to 4.5 %, but boats, cars, and other motorized toys are at 4%, land valuation more than doubled and the state avoided having to match additional general school funding by allowing schools to use up 40% of capital outlay funds to be used for general fund expenses which caused a big shift from towns to land taxes in my district. Farmers’ apathy has cost them a voice at the table.

I live in central Sioux Falls, district 13.

I was in my front yard Saturday morning, 2-weeks ago doing some yard work.

I noticed a woman (is it OK to identify her as a woman) walking up the sidewalk to the front door of my neighbors house to the south. She spent some time talking to my neighbor and I could see that he signed the paper on her clipboard and she proceeded to leave. I thought she was going to stop at my house but she proceeded to walk right by. I assumed she had something to do with a candidate or a voting issue, etc. It was a wild guess on my part. (BTW My neighbor to the north is a huge democrat / liberal) just saying. I smiled and called out to her as she passed by and I said “Are you not going to stop by because I’m on the other team?” She said I was not on her list but she said she would talk with me as she was with the League Of Women Voters a non-partisan group. She was looking for signatures in an effort to take away the ability of state legislators to redraw districts as they were gerrymandering the districts. I said I understand but my goal was to eliminate as many democrats as possible from winning in SD. That’s why I said I was on the other team. We both laughed and said ok then and she proceeded to go to only democratic registered houses in my immediate neighborhood. I know who the democrats are from their yard signs.

It appears to me that she had a list of democratic households in district 13, central SF and was only canvassing democtratic households.

So much for the league of voters being a non-partisan group.

Augie, and thus League of Women Voters is a ‘lib’ bunch, eh? You are so in the right party1

I’d like to see Brown County in only 2 districts with Aberdeen divided, similar to Codington and Watertown. We want to maximize our legislative impact too!