Getting Serious About Cutting Wasteful Spending

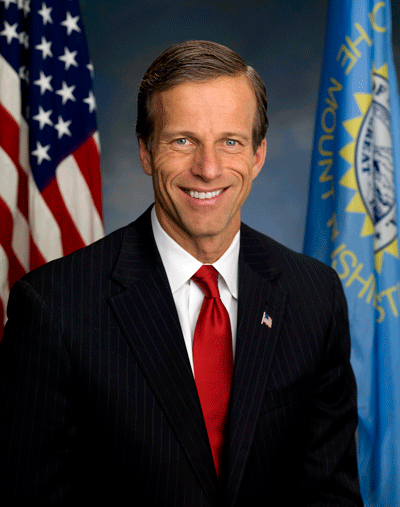

By Sen. John Thune

The need to address the federal budget has only grown more urgent as the Biden administration has racked up trillions of dollars in more debt in the last two years alone. Recognizing that this level of spending is irresponsible and unsustainable, the American people elected a Republican majority in the House of Representatives last year as a check on the president’s policies and Democrats’ reckless spending. Although the president tried to avoid negotiating budget cuts for over three months, Republicans were intent on restoring fiscal sanity to Washington. Divided government requires compromise, and the spending reform deal that Speaker McCarthy negotiated shows what can be achieved when both sides work together.

The bill they agreed to, the Fiscal Responsibility Act, delivers on Republicans’ promise to rein in excess federal spending. It reduces the deficit by $1.5 trillion through spending cuts and by restoring budget caps – all without raising taxes. The Fiscal Responsibility Act also claws back more previously allocated federal funds than any other bill in American history, rescinding tens of billions of dollars in unused COVID funding. And it begins to chip away at the unnecessary influx of money that would have gone to hiring new IRS agents.

Equally as important as limits on spending are the common-sense policies in the bill that limit the size of government. The Fiscal Responsibility Act strengthens work requirements in federal assistance programs to ensure those who are able can move from welfare to work. It makes a down payment on permitting reform that will help get energy projects off the ground more quickly, encourage domestic energy production, and lower costs for American families. And it creates zero new federal programs.

This is not a perfect bill, but these cuts and reforms are important steps in changing the trajectory of the federal budget. At $31 trillion, our national debt is larger than the entire economy, and it continues to grow at an unsustainable rate. Just paying the interest on the debt is taking up an enormous share of the budget. In a few years, unless additional responsible fiscal policies are enacted, interest payments will exceed what we spend on national defense. Think about that – we’re on pace to spend more money on interest payments than what we spend to maintain our top-tier armed forces and other defense capabilities. And it’s out-of-control spending that is driving these concerning trends and jeopardizing our future prosperity.

The policies in this bill won’t magically correct years of wasteful spending, but they are meaningful reforms and spending cuts that mark an important step toward helping to get our fiscal house in order. Our spending problem didn’t emerge overnight, and it won’t be solved with a single bill, but I am committed to restoring fiscal responsibility in Washington, and I hope President Biden and congressional Democrats are as well.

###

Maybe eliminate all freebies for ILLEGAL IMMIGRANTS (not migrants), quit unfairly susidizing NATO, limit foreign aid?

“The policies in this bill won’t magically correct years of wasteful spending” – A Senator who voted for a $3 trillion plus tax cut for the wealthiest Americans, who wants repeal the Estate Tax to ensure billionaires like Muck and Bezos never pay taxes on their wealth, and who literally is part of the body that controls spending.

I hate this timeline.

The Tax Cuts and Jobs Act, the bill to which you referred, increased overall revenues as has happened every time that significant reductions in taxes have been made and it cut taxes for over 90% of the population, including everyone who takes the standard deduction because it was doubled. The Marxist-driven class envy gets old.

Never read Marx, just believe having an entrenched, obscenely wealthy elite class as more compatible with authoritarian governments.

I’m not so sure about curtailing spending on the IRS agents. Tax avoidance is a big industry and should provide a legal avenue for very wealthy people to pay only what they owe. However, there is plenty of illegal avoidance taking place and, it’s only fair, that people who cheat, pay the consequences. Perhaps I’m biased against great wealth. The very wealthy have their own set of problems but, when it comes to taxes, they should at least pay the same percentage of their taxable income that folks of modest income contribute to the nation’s treasury.

Maybe they should claw back some of those forgiven PPP loans too. Magically forgiving loans to Tom Brady, Kardashians, and every other millionaire? Absolute insanity.

Or the children of South Dakota legislators who are already receiving money in other states.

The PPP was one of the biggest frauds in history.