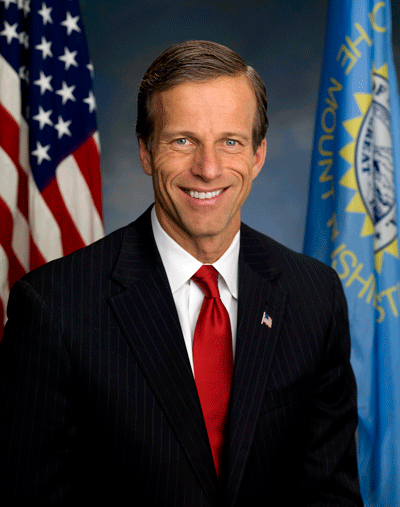

Thune, Brown Reintroduce Bipartisan Bill to Simplify Tax Collection for Individuals Working in Multiple States

WASHINGTON — U.S. Sens. John Thune (R-S.D.) and Sherrod Brown (D-Ohio), members of the tax-writing Senate Finance Committee, today reintroduced the Mobile Workforce State Income Tax Simplification Act, bipartisan legislation that would simplify and standardize state income tax collection for employees who travel outside of their home state for temporary work assignments. The bill would also help employers who must comply with withholding and reporting requirements. Under current law, individuals and employers face different state income tax reporting requirements in almost every state that vary based on length of stay, income earned, or both

WASHINGTON — U.S. Sens. John Thune (R-S.D.) and Sherrod Brown (D-Ohio), members of the tax-writing Senate Finance Committee, today reintroduced the Mobile Workforce State Income Tax Simplification Act, bipartisan legislation that would simplify and standardize state income tax collection for employees who travel outside of their home state for temporary work assignments. The bill would also help employers who must comply with withholding and reporting requirements. Under current law, individuals and employers face different state income tax reporting requirements in almost every state that vary based on length of stay, income earned, or both

While some states require state income tax filing for as little as one day of work in the state, this legislation would establish a common-sense 30-day threshold to help ensure that an equitable tax is paid to the state and local jurisdiction where the work is being performed while alleviating burdensome tax requirements on employees and employers.

“The name of our bill says it all,” said Thune. “If enacted, it would simplify state income tax filings by creating a common-sense, across-the-board standard for mobile employees who spend a short period of time during the year working across state lines. Imagine how complicated and unfair it is for an individual who lives in a state like South Dakota, with no state income tax, to have to file income taxes in multiple states for simply temporarily working in those states – in some cases, for as little as 24 hours – and not be able to recover any income tax payments he or she has to make. The current framework is overly burdensome, and this legislation would provide much-needed relief.”

“We should be making it easier, not harder, for workers to support themselves and their families,” said Brown. “We live in a highly mobile society. People travel across state lines for work. We should be cutting red tape and simplifying the state income tax filing process to help these workers get ahead.”

In addition to Thune and Brown, the Mobile Workforce State Income Tax Simplification Act is cosponsored by U.S. Sens. Tammy Baldwin (D-Wis.), John Barrasso (R-Wyo.), Richard Blumenthal (D-Conn.), Cory Booker (D-N.J.), Maria Cantwell (D-Wash.), Susan Collins (R-Maine), Catherine Cortez Masto (D-Nev.), Mike Crapo (R-Idaho), Ted Cruz (R-Texas), Joni Ernst (R-Iowa), Maggie Hassan (D-N.H.), John Hoeven (R-N.D.), Cindy Hyde-Smith (R-Miss.), Johnny Isakson (R-Ga.), Angus King (I-Maine), Amy Klobuchar (D-Minn.), Patrick Leahy (D-Vt.), Mike Lee (R-Utah), Chris Murphy (D-Conn.), Patty Murray (D-Wash.), Gary Peters (D-Mich.), Rob Portman (R-Ohio), Jack Reed (D-R.I.), James Risch (R-Idaho), Brian Schatz (D-Hawaii), Jeanne Shaheen (D-N.H.), Tom Tillis (R-N.C.), Pat Toomey (R-Pa.), Chris Van Hollen (D-Md.), Sheldon Whitehouse (D-R.I.), and Roger Wicker (R-Miss.).

The Mobile Workforce State Income Tax Simplification Act is supported by over 300 organizations and business groups nationwide, including the South Dakota CPA Society.

###