Biden’s Latest Student Loan Giveaway

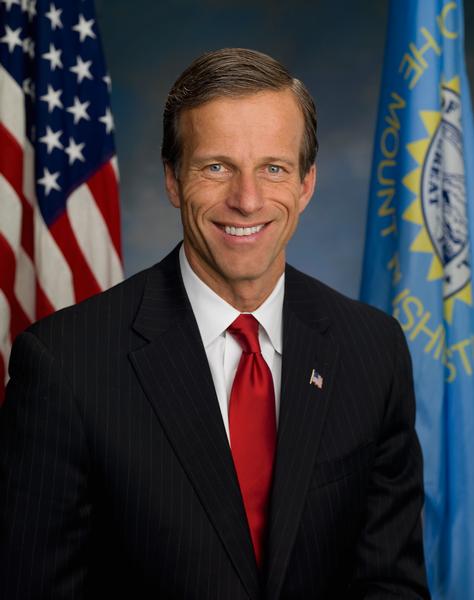

By Sen. John Thune

One year ago, the U.S. Supreme Court rightly ruled that President Biden did not have the authority to unilaterally forgive federal student loan debt. But that hasn’t stopped the president from contriving new student loan giveaways that amount to de facto loan forgiveness and will cost taxpayers hundreds of billions of dollars.

In April, the president announced his latest $150 billion student loan giveaway. Among other things, this latest scheme would waive accrued and capitalized interest for certain borrowers, and it would provide student loan forgiveness to 750,000 borrowers with an average income of more than $300,000.

This comes on top of the $475 billion loan forgiveness plan the president announced last summer. The so-called SAVE Plan will implement de facto forgiveness on a massive scale by creating a system in which the majority of future federal borrowers will never fully repay their student debt. The U.S. Department of Education estimated that undergraduate borrowers would expect to pay back just $6,121 for every $10,000 borrowed. That means that, on average, taxpayers will be taking on almost 40 percent of these borrowers’ student loans.

By one estimate, recent student loan policies will cost more than all federal spending on higher education in the nation’s entire history. For all this money, the Biden bailout plans do nothing to fix the actual problem: the cost of higher education. In fact, they could make things worse. For one, these plans don’t incentivize colleges to rein in their prices. They could also encourage students to increase their borrowing. And then there’s the troubling message it sends to students that they can expect to be bailed out for debt they take on, even though they agreed to repay it.

The president’s student loan schemes all involve a fundamental unfairness though. Many Americans never attended college. Others worked hard to pay off their entire student debt, or they worked to put themselves through college. Many Americans covered the cost of education by serving our country in the armed forces. Why should these Americans have to shoulder the massive cost of all this loan forgiveness now?

My Republican colleagues and I are pushing back against these misguided and costly policies. I’m also working on policies that help people pay off their student debt without putting taxpayers on the hook for massive amounts of money. My bipartisan Employer Participation in Repayment Act became law in 2020. It allows employers to make tax-free payments toward their employees’ student loans. It’s no silver bullet, but it’s a fiscally responsible way of easing the burden of student debt.

President Biden’s student loan giveaways are not the right answer, and they may cause more problems than he claims they will solve. Unfortunately, I suspect the president sees a chance to win a few votes he will need in November – at the expense of taxpayers across the nation.

###

Wow, what a bunch of BS, this propaganda message is tailored to those that do not understand the issue and is to appeal to the message if you didn’t get it, you should be against it. Well, how about being against the tax cuts for the billionaire class, did you get any of that? How about the roads you pay for all over the US, but you don’t get to use all of them? How about the EB-5 visas that bring in non-residents that can be paid the federal minimum wage ($7.25 /hr), then be subsidized with food stamps and government housing, and the extra profit goes to those that donated to the politicians, did you get any of that?

The reality is the laws for the student loans have been set since the 90’s, and congress (the one that John is part of) sets the interest rate. While we had 2% home loans, John and his friends were setting %8.5 for student loans. Also, John and his friends can cap loans TODAY, I wonder why nobody has drafted legislation to do that, hmmm……

Furthermore, the 90’s era program allowed forgiveness after 20 or 25 years of payments, that is the law. The Biden admin is following the law, John is again, in his MAGA ways, asking for the executive branch to ignore the law, and enact powers to over-ride congress. The revised process to conform to the law, won’t be over-ruled by SCOTUS again, unless they use a different route (claiming the entire process is unconstitutional maybe), which would cause chaos with everyone who had loans from the 90’s.

What I gather from this message, if you want a chance to pay back your student loans, don’t vote for MAGA. Canceling the SAVE plan would put every student loan holder in debt that can’t be paid back, all while the billionaire donors supporting John pay little to nothing. Take your pick….

Their goal is to kill public education and create an uneducated, poverty stricken class of people to replace the cheap immigrant labor. Maga will go to bat for the billionaire class while shooting themselves and their future generations in the foot. All because they actually believe someday they will get out of the trailer court.

Just a couple facts for the two writers above.

1. 90% of US taxpayers received a reduction in their taxes paid with the 2017 tax cuts.

2. Revenues received by the federal government increased after the tax cuts.

3. It is hard to give tax cuts to people who don’t pay taxes, which is moving to a higher percentage of the population every year. If they don’t pay income taxes, it is called welfare.

4. 1% of the US taxpayers earn 22% of the total income and pay 46% of the total taxes paid. How much would be their “fair share”.

Student loan bailouts is nothing more then a scheme to buy votes and have those of us who paid our loans and those who did not attend college pay the bill. Not fair!

You conveniently leave out the “wealth” aspect. How much wealth is held by that 1% to which you refer?

Why don’t you explain the “wealth” aspect to which you refer.

as usual th notion that “the rich” got tax cuts ignores the fact that deductions for state and local taxes were capped.

90% of tax filers are now filing the standard deduction, whether they realize it or not. Everybody who files the standard deduction got a big tax cut.

On the other hand, it was the Affordable Care Act which took over the student loans as a funding mechanism and turned the federal government into a predatory lender, so….

See how those “tax cuts” work for you next year as everything is set to expire. Also, Trump put in a bunch of trigger tax codes since he thought he would be turning this over to a possible opponent since he was so convinced he would win. There are a lot of deductions that were removed or amortized that affect S corps (most small businesses), this year. Trump and MAGA are anti-small business, and the GOP is filibustering the solution (which the house passed bipartisan) in the Senate. [H.R. 7024]

Quit leaving out the important facts, it makes you look stupid to those of us that are not. This isn’t a MAGA rally where everyone will cheer just by you farting in the mic.

The wealth tax breaks from both Trump and Bush combined could stop our national debt from increasing. It’s their goal to cut taxes and make programs insolvent and then blame democrats for the mess they create. Republicans will saddle the middle and lower class with more responsibility and give the wealthy more breaks. Rural America and red state welfare queens like SD will suffer immensely.

https://thehill.com/business/4736740-trump-biden-fiscal-policy-deficit/

Republicans are always delirious when it comes to the economics. Not only did Trump spur more inflation, he did it to benefit the wealthy while Biden is actually investing in the people. All those road and water projects, infrastructure dollars, it came from Biden. I’ll take that debt over the tax increases Trump will give me when the fed cuts spending to appease the wealthy donors.