Proud to Be an American

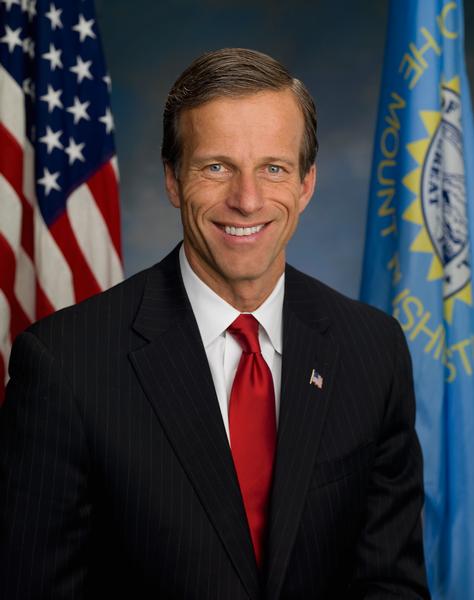

By Sen. John Thune

The Fourth of July means many things to many people. It’s an opportunity for communities to come together for picnics and parades. It’s a time for friends and families to gather and create new memories. And while we celebrate all of the blessings and opportunities we have as Americans at parades, barbeques, and fireworks shows, we must not overlook the true meaning of the holiday – we should honor our freedoms that have been paid for by the sacrifices of so many Americans past and present.

On Independence Day, I’m reminded of our Founding Fathers who put together the greatest statement of self-government the world has ever seen: the Declaration of Independence. They proclaimed that “We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable rights, that among these are life, liberty, and the pursuit of happiness. That to secure these rights, governments are instituted among men, deriving their just powers from the consent of the governed.”

America is the greatest country the world has ever known, not only because of what we have achieved, but because we’re humble enough to know that we always have room to listen, learn, and grow as we continually strive to live up to the founding principles of the Declaration of Independence. The rights that the founders described in that document aren’t determined by one’s social status, where an individual is born or raised, or even any standard set by government itself. That’s what makes them so unique. They’re granted to us by God. They are unalienable. And the governments born from these free people are created and maintained with their consent. That’s pretty remarkable when you think about it.

As we celebrate the stars and stripes, we also honor those who served and continue to serve our great nation, paying tribute to them by upholding the values for which they continue to fight. I think about my father, Harold, a fighter pilot who flew Hellcats off of the U.S.S. Intrepid in the Pacific theater during World War II. Through him, I learned about the Greatest Generation – their humility, their quiet service, and their dedication to the cause of freedom. The stories my dad would tell us about the men he served with will stay with me forever – these men were driven by an unwavering love for our country, full of pride and patriotism. The world had never met, nor will it meet again, a group of individuals so dedicated to the pursuit of freedom and democracy around the world.

Our nation continues to have the blessings of liberty and freedom our forefathers sought for future generations of Americans. The Founding Fathers dedicated their lives to creating our great nation, and the brave men and women who have answered the call to serve continue that fight today. We are forever grateful for their bravery in defending freedom, liberty, and the American dream.

###