Republicans Are Working to Make the Tax Cuts Permanent

Republicans Are Working to Make the Tax Cuts Permanent

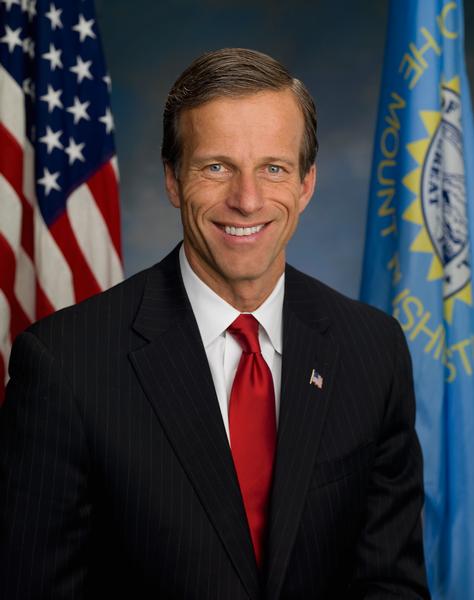

By Sen. John Thune

It’s that time of year again: Tax Day. I don’t know anyone who looks forward to April 15th. Whether you’re getting a refund or you owe money to the IRS, I think most South Dakotans would rather they were keeping more of their money and sending less to Uncle Sam.

Republicans agree, which is why we worked so hard to pass the Tax Cuts and Jobs Act (TCJA) in 2017. As a result of these tax cuts, most Americans had a smaller tax bill. And while most Americans paid less in taxes, revenue was actually greater than expected, because our economy grew, businesses created jobs and poverty decreased.

These are significant gains, but they’re at risk next year if TCJA is allowed to expire. If these tax cuts aren’t extended, it would mean a $4 trillion tax hike on American families and small businesses, including farms and ranches. Republicans won’t let that happen. We’re working hard to make these tax cuts permanent and protect hardworking families from a bigger tax bill next year.

Without extending the tax cuts, a typical family of four would see a $1,700 tax hike next year. The child tax credit would go from $2,000 to $1,000 per child. The standard deduction, which is used by most tax filers, would drop from about $30,000 for a married couple to about $16,000. So it’s critical that these tax policies be extended to ensure South Dakota families don’t face smaller paychecks and bigger tax bills next year.

Extending the tax cuts is also critical for small businesses that would otherwise face a $600 billion tax hike. Most small businesses benefit from a 20 percent small business deduction that was included in TCJA. This deduction helped business owners invest in their operations and create jobs, and extending this tax policy will ensure they can continue to be an engine for growth.

Making TCJA permanent will also be good for our economy. In the years after the law first passed, the economy grew faster than expected. We saw a 50-year low in unemployment. Poverty fell to a record low. And there was a narrowing of the income disparity in our country. And by extending this tax policy we can bring in more revenue the right way – by growing the economy.

Of course, we can’t deny that our country has a deficit problem, a problem driven chiefly by out-of-control spending. Unfortunately, we saw an incredible growth in government spending under the Biden administration. Federal spending in 2024 was 54 percent higher than it was in 2019. And as part of our agenda, Republicans are going to take a good, hard look at how taxpayer dollars are being spent and work to return the nation to a more sustainable spending and fiscal trajectory.

The Tax Cuts and Jobs Act was a major success in President Trump’s first term. It delivered on its promise of lower taxes, greater growth, and a stronger America. We have an opportunity to make those gains permanent and to set our country on a course for a healthy economy for years to come. We plan to seize that opportunity and deliver permanent tax relief for the American people.

###

The nation’s debt exploded in Trump’s first term, and so far he has vastly outspent whatever Biden spent in his first 100 days, in addition to ruining the reputation of the US for decades to come. A press release like this sounds like it’s from a Congress which is acting for the American people. The real Congress we observe in inaction each day is not like the one you read about here. John you’re just pretending normalcy to buy Trump time to do whatever his plan is. Shame shame.

Deficit doubling billionaire bailout bs.

Socialism for Billionaires. Elon Musk and the rest thank you Senator Thune!

Tax cuts Thune is bragging about helped create the $7.8 trillion increase in the US national debt during Trump’s first term. Targeted tax cuts were not the goal of the Trump tax cuts, making corporations and multi-millionaires even wealthier was. The good Senator does not fool anyone with his comments about helping families and the working class.

Wow, that picture is a little out of date. Lying for Trump really takes a toll on your body and soul.

John, cut there crap, Republicans are bad for the national debt and bad for the economy.

Spend more? Check. Take in less revenue? Check. Implement massive, not targeted like Johnson claims, across the board tariffs against the entire planet? Check. Ignore the President shuttering agencies he literally lacks the power to close? Check. Ignore the President using executive orders eliminating birthright citizenship, a right protected by a constitutional amendment? Check. Ignore the use of signal to transmit sensitive military info, info which was subsequently sent to a reporter BEFORE the air strike, while being one of the most vocal critics of Killary using a private email servers? Check.

Yeah, John. You sure are looking out for the nation and constitution. Way to go.

And you can read off the delusional dumocratic talking point sheet. Check.

thanks for playing.

Got any wrong statements to make today or would you like to discuss some of your past wrong statements?

thanks for playing.

Hmmm. If you think these permanent tax cuts or anything that is happening right now is okay or normal, I’m not sure you’re putting “dum” in the right place.

Stupid boomerism ad-hominem attack without refuting any talking points? Check.

These tax cuts are a joke.

https://www.chicagobooth.edu/review/trump-tax-cuts-benefits-outweighed-lost-revenue

“Stupid boomerism ad-hominem attack”

Only a millennial can’t see the irony there…

Calling a spade a spade. You still haven’t proven that these cuts are good yet.

https://budget.house.gov/press-release/despite-cbos-predictions-trump-tax-cuts-were-a-boon-for-americas-economy-and-working-families

A partisan press release? With absolutely no supporting data cited? Not proof, nor does it even refute the point that these tax cuts haven’t been worth the squeeze.

Found the guy smoking copium out of those Chinese vapes.

https://apnews.com/article/house-republicans-budget-blueprint-trump-tax-cuts-ff2bddf31f4e7cb0928139072392a091#

Story links from December and February may as well be ten years old, for all the current relevance they have in this dazzling jerk-and-drive Trump-cession.

Which of the things I wrote is false? Name one.

Dear Anonymous@9:59…

Those things may be true but the inauguration was only two months ago and you’re kind of drizzling on the parade here.

It’s finally time! Our billionaires are getting frightfully little back from our federal government, and they are, by virtue of being billionaires, ever so deserving of our good charity. Thank God for those who have so much more than all us!