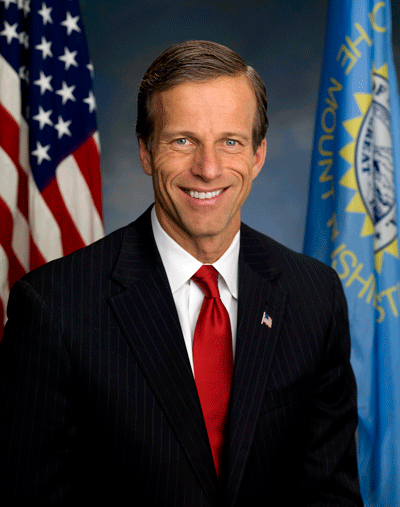

Thune Reintroduces Bill to Add Certainty to Worker Classification Rules

“It’s important for Congress to keep up and provide much-needed clarity on how the IRS should treat this new generation of workers, which is exactly what my NEW GIG Act would accomplish.”

WASHINGTON — U.S. Sen. John Thune (R-S.D.), a member of the tax-writing Senate Finance Committee, today reintroduced the New Economy Works to Guarantee Independence and Growth (NEW GIG) Act (S. 700), legislation that addresses the classification of workers – independent contractors versus employees – and creates a safe harbor for those who meet a set of objective tests that would qualify them as an independent contractor, both for income and employment tax purposes. This legislation is important for traditional independent contractor arrangements, like computer consultants, freelance writers, and delivery drivers, as well as all of those individuals who participate in the gig economy and provide a rapidly growing range of services.

“From rides to the airport to food delivery to handyman services and more, the ‘gig’ economy is playing an increasingly important role in our daily lives,” said Thune. “These new gig companies and the freelance-style workers they partner with have transformed our way of life and pushed the boundaries of how current law deals with businesses and service providers. It’s important for Congress to keep up and provide much-needed clarity on how the IRS should treat this new generation of workers, which is exactly what my NEW GIG Act would accomplish.”

The bill would create a safe harbor based on objective tests, which, if satisfied, would ensure that the service provider (worker) would be treated as an independent contractor, not an employee, and the service recipient (customer) would not be treated as the employer. In the context of the gig economy where an internet platform or app facilitates the transactions and payments, that third party would also not be treated as the employer. Click here for a full summary of the bill and here for bill text.

The NEW GIG Act was included in the chairman’s mark of the Tax Cuts and Jobs Act, which Thune helped write, but was removed from the committee-reported bill for parliamentary reasons. Companion legislation was introduced earlier today in the House of Representatives by U.S. Rep. Tom Rice (R-S.C.).

###