IRS Needs to Do More to Protect Taxpayer Data

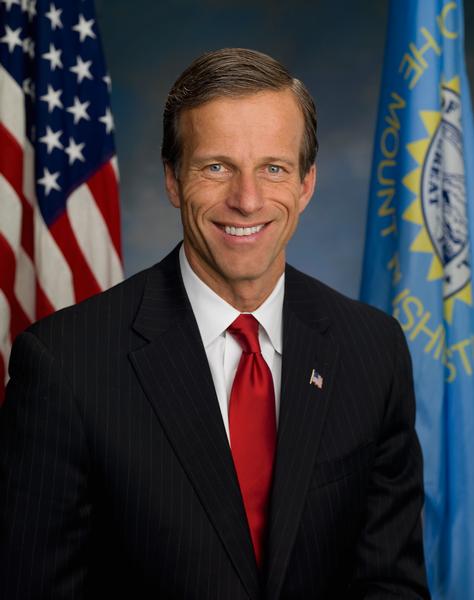

By Sen. John Thune

In 2022, Congress passed the No TikTok on Government Devices Act. As its name suggests, this law bans TikTok on government devices due to the significant security risks that the app poses. This was an important step to protect sensitive data and government networks, but a recent report indicates that the Internal Revenue Service (IRS) has not fully complied with the law.

A recent inspector general report revealed that 2,800 mobile devices used by IRS Criminal Investigation employees and computers assigned to those employees can access TikTok. The inspector general also found that the IRS has not updated its “Bring Your Own Device” program, which shockingly allows IRS employees to use personal devices for business purposes. That means that IRS employees who are accessing sensitive taxpayer information on their personal devices are also potentially accessing TikTok. Worse still is that the IRS won’t commit to complying with recommendations to resolve the personal device issues until October 2024.

As the lead Republican on the Subcommittee on Taxation and IRS Oversight, holding the IRS accountable is an obligation I take very seriously. In response to this troubling report, I recently sent a letter to the IRS commissioner requesting information about the agency’s compliance with the No TikTok on Government Devices Act, the IRS’s “Bring Your Own Device” program, and the security of taxpayer information being accessed on personal devices. TikTok’s close ties to the Chinese Communist Party and their troubling data practices are reasons to be concerned about the app being loaded onto or accessible on a device that also deals with taxpayer and government data. This warrants swift action by the IRS to comply with the law and protect Americans’ data.

Unfortunately, this is only the latest issue in the IRS’s troubling history of mishandling taxpayer information. In the last few years alone, the IRS has inadvertently posted confidential information from 120,000 taxpayers on its website, destroyed 30 million unprocessed tax documents, and tens of thousands of Americans’ tax information was stolen by an IRS contractor and wound up in the hands of the left-leaning news site ProPublica.

The American people should be able to trust that when they file their taxes with the IRS, their personal information is safe. I will continue to hold the IRS accountable for its handling of taxpayer information and ensure the agency is adequately protecting Americans’ information.

###