Tax Reform is Working

Tax Reform is Working

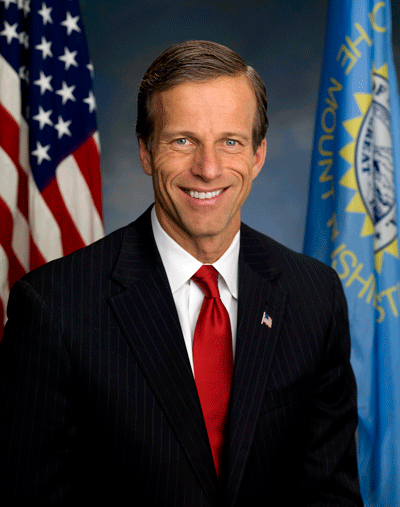

By Sen. John Thune

Find me one person who enjoys paying taxes, and I’ll find 10 million other people who’d rather not. While few taxpayers, if any, are doing cartwheels over giving Uncle Sam part of their hard-earned paycheck, almost everyone recognizes that it’s important to pay a share of our nation’s tax burden. It’s what helps fund the military, pay for our nation’s roads and bridges, and support numerous federal programs on which many Americans depend.

Yes, taxes are necessary, but I strongly believe that the federal government shouldn’t spend one penny more than what’s required to meet our obligations. There’s a ton of waste, fraud, and abuse in federal spending, and correcting that problem has long been a mission of mine. We’ve made progress in certain areas, but there’s a long way to go toward fully restoring fiscal responsibility in Washington.

I think one of the best ways to force the government to spend taxpayers’ money more efficiently is by simply taking less of it in the first place. Fulfilling that goal – allowing people to keep more of their own money – is exactly why I helped write the Tax Cuts and Jobs Act, which became law in December 2017, and this year’s tax season is the first in which Americans will file their taxes under the new system.

This year, filers will notice several positive changes, all of which mean more money in the family budget. First, lower rates, which has resulted in 90 percent of middle-income Americans seeing a tax cut of their own. Ninety percent. Second, doubling the child tax credit, which, again, helps support middle-income Americans. And third, nearly doubling the standard deduction – a fancy way of saying the government will tax less of what you earn.

As with most tax seasons, many Americans are accustomed to receiving refunds this time of year. And they should, especially if they overpaid the government during the previous year. While a lot has been made recently about the fact that some tax refunds are slightly lower than they were last year at this time, people probably aren’t hearing why that could actually be a good thing, because at the end of the day, a tax refund doesn’t reflect a person’s tax burden.

Getting a tax refund essentially means you gave the government an interest-free loan during the year. It’s your money, and you only owe what you owe, so anything you pay above that, the government will graciously hold on your behalf (money it can use until they have to return it to you later). In a perfect world, though, no one would receive a tax refund because everyone would pay exactly what they need to during the year. So, thanks to tax reform, since rates are lower and the government took less of your money on the front end, a smaller refund means you made a smaller loan to Uncle Sam, not necessarily that you paid more in taxes.

In a post-tax reform world, job creation and wages are up. So is economic growth, personal income, and business investment. Importantly, unemployment is down. So far down that in 2018, for the first time ever, the number of job openings outnumbered the number of job seekers, which means there’s less competition among those who are looking for work. More than 3 million jobs have been created since tax reform became law, and a typical family of four received a tax break of more than $2,000. All good news.

Like I said, there aren’t many people who enjoy tax season, but with all of the positive changes we’ve seen through tax reform, hopefully this year was a little less painful. There’s more to do, though, and Republicans in Congress are committed to building off of this success as we pursue additional pro-growth policies that will continue to put you in the driver’s seat of your own economic future.

###

South Dakota is in the midst of a natural disaster after trying to recover from another and he’s talking about tax reform? At least Rounds, likely his staff, had the sense to write about something relevant.

If he was serious about being a fiscal conservative we would see him voting to cut funding for the Overseas Contingency Operation, he would vote to implement multiple IG recommendations on cracking down on Waste, Fraud, and Abuse for Federal Agencies – DoD is one of the worst for this, he would work to reign in over-bloated defense contracts that continuously go over budget and blow past deadlines.

I have no problem paying taxes so long as i know the taxes are going to make things better such as infrastructure. I have no problem with the Federal gas tax being raised so long as i know the revenue raised is explicitly used for infrastructure and not the pork barrel buffet. Why not change the formula funding to better benefit rural states by increasing the share of funding?

Yes we Americans enjoy paying taxes so a dysfunctional Congress can misspend it over childish political wars and nonsense expenditures. Its time for a real change in America and an overhaul of the entire federal bureaucracy and give the country back to its people.

As for Senator Thune’s state, it is known as one of the most corrupt states in the union with zero oversight by the people in bringing its governmental criminals to justice. South Dakota loves its refugees and illegals and will afford them with every consideration so a few people can make millions in the state by hiring them at substandard wages.

I’m in favor of lowering taxes, especially for middle-income earners. But where has the discussion over spending cuts and entitlement reform disappeared to? I don’t want to hear about democratic obstruction, we had both chambers and the White House. It seems like any meaningful narrative of how we can get our national debt under control has been completely abandoned for back slapping over lowering taxes. Leadership is taking difficult action, often through compromise. I for one would rather see some “deals” which actually get us somewhere toward tackling our debt than simply “wins.”

Funny how the comments revolve around fiscal conservatism and accountability… every one of the frequent commenters fall silent.

What a waste of digital ink trying to explain away a massive handout to corporations at the expense of individuals. I thought John was a fiscal conservative??!! C’mon Man, tell the truth.

John, you may be hitting the 30% of people stupid enough to believe what you’re doing. (they all reside here) You are forcing Americans to borrow $19 billion a month to pay for the wealth transfer to the richest.

John, you are complicit. Shame on you. Shame.