The South Dakota Municipal Association’s latest monthly newsletter has the group coming out hard against Initiated Measure 28, the ballot measure that’s going to stick up with an income tax if it passes, because there’s no other way to make up the massive amount of revenue that will be lost.

Sara Rankin, the Executive Director of the Municipal League, penned this editorial explaining the impact the passage of this ballot measure would have on our communities:

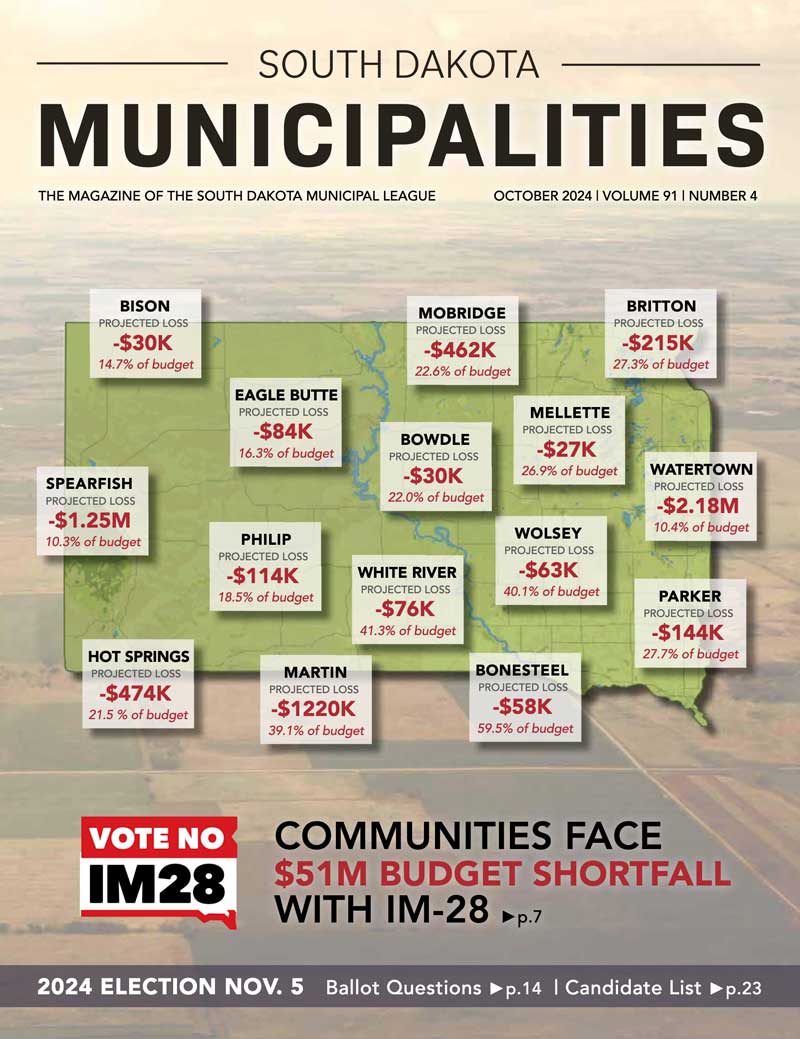

As South Dakotans head to the polls next month, a critical ballot measure, IM-28, promises to reshape our state’s tax landscape. While its proponents argue it will simplify tax collection and provide relief for consumers, the hidden cost of this measure is a potential $51.5 million blow to municipalities across South Dakota.

IM-28 proposes to alter the current taxation framework by removing state level sales tax on II anything sold for human consumption. On the surface, this might seem like a win for consumers, however, this measure is in direct conflict with South Dakota Codified Law (SDCL) 10-52-2, which allows cities and towns to impose a sales tax of up to 2% on the same items taxed at the state level. If the state stops collecting tax on these items, municipalities would be forced to follow suit, effectively cutting off a crucial revenue stream.

The Attorney General 1s opinion on IM-28 underscores the gravity of this issue. According to the opinion, the measure “may affect the state’s obligations under the tobacco master settlement agreement and the streamlined sales tax agreement.“

Furthermore, the vague language of “human consumption” in IM-28 opens the door for broader implications. This terminology could lead to the repeal of sales tax on various everyday items beyond just food and beverages, including tobacco, candy, soda, and medicines.

Should IM-28 pass, municipalities stand to lose an estimated $51.5 million in revenue. This figure is not just a statistic but a reflection of the vital services and infrastructure that would be jeopardized. The financial shortfall could cripple efforts to fix streets, update aging infrastructure, and maintain city facilities such as libraries and swimming pools. Parks, which offer essential recreational spaces and community gathering spots, could face reductions in maintenance and programming.

IM-28 undermines the financial stability of local governments, placing an undue strain on municipal budgets and forcing cities to find alternative revenue sources or cut essential services. Such a scenario would likely lead to higher property taxes or other local fees, placing additional financial pressure on residents already grappling with economic challenges.

It is essential to recognize that while IM-28 may offer short-term relief for some, the long-term consequences for South Dakota’s municipalities are severe.

In making an informed decision about IM-28, South Dakotans must weigh the immediate benefits against the substantial costs. The health of our municipalities, the upkeep of our infrastructure, and the quality of our local services are all at stake. Before casting a vote, it is crucial to consider whether the suggested benefits of IM-28 outweigh the very real and potentially devastating impacts it could have on our local communities.

Sincerely, Sara Rankin

SDML Executive Director

And realistically, how can a city like Hot Springs or Spearfish lose between 20% to 60% of their annual budget, and still perform those tasks such as road maintenance, snow removal, or provide a police force?

You know the answer. They can’t.

Well intentioned or not, this measure might be the scariest thing on the ballot this halloween season.

There will not be a state income tax if IM 28 passes. The AG statement clearly states legislative clarification will be necessary. The 2025 Legislature should plan on defining human consumption and allowing municipalities to tax items not taxed by the state.

Oh look! A simple solution rather than fear mongering!

There will still be a budget shortfall that has no plan to recouperate the lost revenue. Then when cuts to education are made people will be screaming from the rooftops like they did during the Daugaard Admin. Disctricts around the state are opting out just to pay teachers.

Perhaps they can finally start putting the $80,000,000 annual surpluses to use.

What city council are you on that you have to balance the budget? What branch of state government are you in where you have to balance the budget? Or is this another arm chair quarterback opinion of “it’ll be fine because I said so?” Do you have kids in school? Do you enjoy you communities streets being cleared of snow? What about city parks being mowed? If you receive any kind of state assistance, say goodbye to that. If this passes, the legislature has to abide by the IM. They can define human consumption, but they can’t waive a wand and let municipalities to tax items. Your simple solution is not a solution at all.

If you think the SD Legislature doesn’t alter laws after voters pass initiated measures you’re living under a rock. They most certainly can amend the relevant statutes during session.

“Property taxes are the primary source of funding for schools, counties, municipalities and other units of local government.” https://dor.sd.gov/individuals/taxes/property-tax/

Given the s-storm in June, and the fact that so many good sense legislators were replaced by one-issue candidates, South Dakotans are really gonna find out that they will reap what others have sown.

People should be careful about crying “IWOLF!” The text of IM 28 specifically states “This provision has NO EFFECT on the taxing authority of municipalities.” (emphasis added)

To claim that IM 28 would have a catastrophic impact on local governments in SD is fiction. Meanwhile, they want to censor the measure’s sponsor for some perceived slight, and we’re supposed to take all of this seriously. Just happy I’ve already voted.

Where in the text of IM28 does it say that? Here is the exact wording of the IM: “Notwithstanding any other provisions of law, the state may not tax the sale of anything sold for human consumption, except alcoholic beverages and prepared food. Municipalities may continue to impose such taxes.” I don’t think I’m dyslexic and I’ve always been able to read fairly well, but maybe I’m missing the wording you’re claiming is in there. I’m not seeing it though.

If you want to claim that “Municipalities may continue to impose such taxes” is what you’re talking about, that’s a losing argument. What taxes is that sentence talking about? Alcoholic beverages? Prepared food? Tax on everything? It is unclear because it is a terribly written IM.