I was doing a little snooping in the campaign finance reports for the New Approach South Dakota Group, and unexpectedly stumbled across an item which potentially could be a campaign finance violation.

And if true, one that could cost them plenty. Nearly $14,000 of plenty.

NEWAPPROACHSD_DONATIONJAR by Pat Powers on Scribd

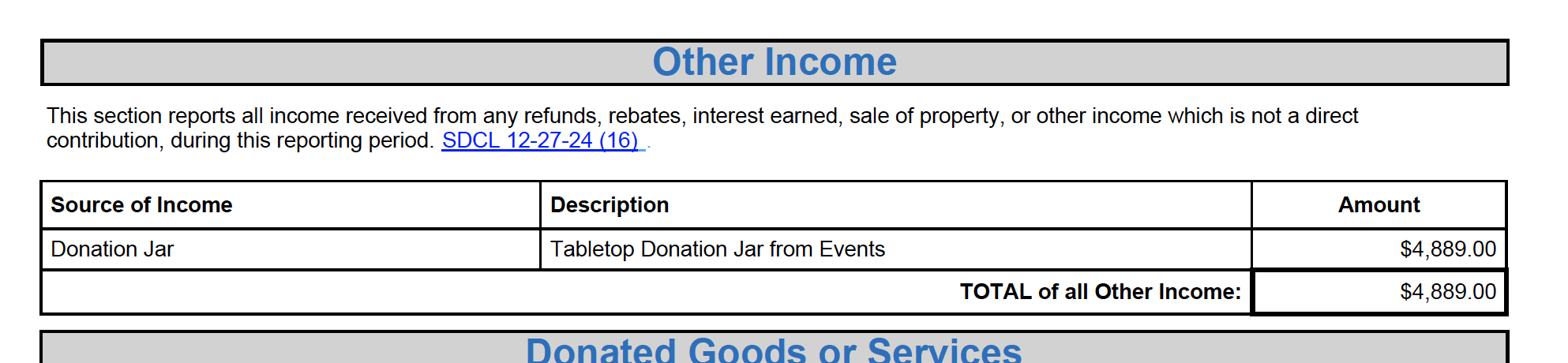

Under the group’s separate committees, New Approach South Dakota Rec (for recreational pot) and New Approach South Dakota – Medical Cannabis, on both reports filed in January of 2018, the group reported donations under “other income” of “Donation Jar.”

Under New Approach South Dakota Rec, Melissa Mentele (who filed both reports), indicated the group collected $4889.00 via donation jar. Under New Approach South Dakota – Medical Cannabis, Mentele reported the group collected $8,957.89 via “Event Donation Jar.”

Why is it a problem that Mentele reported donations of $13,846.89 via a donation jar? Because of SDCL 12-27-11. SDCL 12-27-11 provides the following:

12-27-11. Required information about contributors–Contributions from unknown source to be donated to charitable entity–Violation as misdemeanor. No person, entity, candidate, or political committee may give or accept a contribution unless the name, mailing address, city and state of the contributor is made known to the person, entity, candidate, or political committee receiving the contribution. In addition to any other information to be made known under this section, the name of the custodial parent or parents of an unemancipated minor who makes a contribution shall be made known. Any contribution, money, or other thing of value received by a candidate or political committee from an unknown source shall be donated to a nonprofit charitable entity. A violation of this section is a Class 2 misdemeanor. A subsequent offense within a calendar year is a Class 1 misdemeanor.

As it was in effect in 2018 when this report was filed, the only difference was that the notation of children’s donations had not been added to the law. But the law was in full effect when it came to the anonymous donation. Such as you’d see in a donation jar.

Did Secretary of State Shantel Krebs fail to raise the question of whether this was a violation at the time? I’m not seeing any amendments to the reports in the Secretary of State’s campaign finance system, so I can’t confirm or deny that. But at least on the surface, when they’re reporting “donation jar” donations themselves, you might be in good company if you think there might be an issue.

And I’m not aware that any statute of limitation has eclipsed the violation 18 months later, especially for the “New Approach South Dakota – Medical Cannabis” group which remains an active organization.

This could pose a problem. Especially if there’s an issue and the group needs to cough up nearly $14,000.

Wow. That could not possibly be legit.

Shady & sloppy businesses practices are not uncommon when it comes to anything related to MJ

I suggest you call the SOS office and ask your questions instead of writing a blog post that is misleading. The largest donation from the fish bowl was 500.00 and it is claimed separately. The rest was change & denominations under 100.00. We did a ton of booth space last time around. It was great. Its too bad the state used the new laws to prevent that this time around. Want a real story find out why a Feb 11 submission ended up taking 6 months to get approval to circulate. If you want to grow an actual following cover issues that matter and quit trying to create drama when a 2 minute phone call to the state would have answered your questions.

You can suggest it, but it was your financial report. And it seems to bear further examination, because “fish bowl” anonymous donations were not legal at the time of filing and may bear further scrutiny.

We filed exactly like we were told to by the SOS office after asking our own questions regarding having the fish bowl be so lucrative. It was covered when we spoke with the state revenue reporting as we did free will donations for shirts, stickers, cookbooks and necklaces to find out if the items were to be taxed as we didn’t sell them we did donations for them. You can see the purchase of these items on the report in both our printing costs and tabletop supplies.

We are always diligent in our efforts to abide by the law and follow all the rules. Its not as though we are trying to legalize ice cream Pat. Our work is already controversial enough without adding in an avoidable mistake.

We have a very open line of communication with the SOS office and they have been great about advising us when they can and going to the AG office when they needed further clarification. We welcome your inquiry.

“No person, entity, candidate, or political committee may give or accept a contribution unless the name, mailing address, city and state of the contributor is made known to the person, entity, candidate, or political committee receiving the contribution. …..

Any contribution, money, or other thing of value received by a candidate or political committee from an unknown source shall be donated to a nonprofit charitable entity. A violation of this section is a Class 2 misdemeanor. A subsequent offense within a calendar year is a Class 1 misdemeanor.”

Don’t worry. I’m sure someone will be checking your work.

Read that first paragraph Pat. Made known to the committee, the committee being US, the people donating were people signing the petition so we met the criteria of name, address, city, state and ironically their county of registration. There is nothing in the law that says it has to be reported to state unless it hits a certain denomination. As I stated before we already covered this issue with 3 state offices.

That’s a creative interpretation. The question is whether it meets the requirements of 12-27-11. But as I said, I’m sure someone will be checking your work. Trust, but verify.

What is creative about it? As long as NASD has record of those who donated, there is nothing wrong. You must be confusing that code for another, possibly reporting requirements? Looking at the statute you posted, they have done nothing wrong and that doesn’t take any sort of creative interpretation.

As long as they have records….

So you are basing your entire criticism on something you don’t know and suggesting the SOS failed at their job? Good luck with that. You are now operating at the same level of the fake news media who are quick to push a narrative that is based on little to no investigation. You probably should call the SOS to verify before you look bad and have to post a retraction but we both know you would never do that anyways.

I’m basing it on the notation in the filed report, and the law. As I said, I’m sure someone else can check their work.

Actually there is nothing in the code that requires record keeping for any denomination under 100.00. Which is why the 500.00 donation was reported as an individual donation and not part of the fishbowl even though it was a fishbowl donation for 5 shirts. All the law states is at the time of the donation that the one receiving the donation know who is giving it. Nice creative interpretation of the law though.

As stated above you are welcome to check the states work on this issue. To think that they would not have clarified this prior to our reporting is funny. We did our part and asked all the questions and complied with the laws as instructed.

Have a good night. Pat will you send over your advertising rates? We seem to be a big topic over here and would like to consider the opportunity of advertising here so people can be directed straight to our site to see what we are up to.

12-27-24. Contents of campaign finance disclosure report. A campaign finance disclosure report shall include the following information:

(12) The name, mailing address, city, and state of each person making a contribution of more than one hundred dollars in the aggregate during any calendar year and the amount of the contribution. …. If any information required by the section is unknown to the political committee, the political committee may not deposit the contribution;

One would have to keep records to determine the aggregate. Between 12-27-11 and 12-27-24, claiming you don’t have to have any records underlines the need for verification.

At no point did I state we have no records. I simply stated the law as it reads. You are trying to twist that into something it is not. Have a good night.

Anonymous donors can just slip $50s to the sticky icky marijuana crew & repeat as often as desired? huh. that’s one gaping loophole. why does anyone bother to report? assumed the system was more secure & transparent, but it’s not my field.

Actually, they can’t. They have to have records, whether it was above or below $100. Which is why it bears further scrutiny to see if they actually do have those records.

They basically took out a bullhorn and blared that they seem to have been accepting anonymous donations by reporting it the way they did.

That makes more sense. Again, I’m no rules expert, but if Vinnie Antonelli can stuff a wad of $50s into someone’s political donation jar, and that entity can claim it’s just small bills and coin donated by little kids & who-cares-who, it makes a travesty of the SD reporting requirement

As long as Vinnie leaves his info and donates less than the reporting requirements, everything is fine.

Good work Pat !

This reminds me of the political parties simply listing “Tickets” and the aggregate number on the CFR filed after a Lincoln Day Dinner and whatever the Dem equivalent is.

Now, county parties do have the lists of names of people who bought tickets but they should just get in the habit of listing everyone individually and not getting lazy in their filings.

How many times has this blog requested that those records are reviewed? I bet when it comes to Republicans, never.

If a Republican listed 14,000 worth of aggregated “fishbowl donations” across 2 reports, I certainly would. Most Republicans know better.

grudznick is studying the issue, with a blind eye to the demon weed questions.

I will rule shortly, and Ms. Mentele will then have to abide. The only appeal available is a 200 word (or less) blogging posted here, with pictures.

no one has tried to make this into a debate about pot yet.

If one can dismantle and demoralize, the issue at hand becomes irrelevant. It’s a technique often used in politics. I just thought most Republicans were better than that.

“I thought most Republicans were better than that.”

Maybe. You might be sincere, meaning you had enormous & admiration for Republicans until just now. But even if that’s true, the argument doesn’t work because it’s been done to death by partisans who use it disingenuously. No one buys it. Not anymore.

“Separate immigrant families at the border? I thought Republicans were better than that!!!”

Really? Then why call Republicans Nazis since 2000? Remember when Mitt Romey’s so-called “war on women” was an evil plan to return us to medieval times and burn women at the stake? Remember when liberals called John McCain Hitler, called George W. Bush Hitler, & called Donald J. Trump “literally worse than Hitler.”

When democrats said Reagan invented AIDS to exterminate the gay community, said GHWB invented crack to genocide African Americans, & said that voting for Trump makes someone a white supremacist, the dems lost the “I thought you were better than that” card.

The same people who celebrated the death of ”nazi” GHWB & who think they live in the handmaid’s tale will have a hard time convincing me they so deeply respect Republicans as to be *shocked* dismayed, and disappointed by whatever political maneuver they currently oppose.

Or maybe I’m wrong. Maybe you voted for Bush and Trump and Kristi Noem but this week, Pat went too far. On principle, you decided you must draw a line HERE: Pat’s demand to report the names of political donors (instead of just putting “donation jar” next to $14K) caused you to re-evaluate your decades of respect & support for conservatism and its champions. ok. if you say so.