Tax Relief, Not IRS Grief

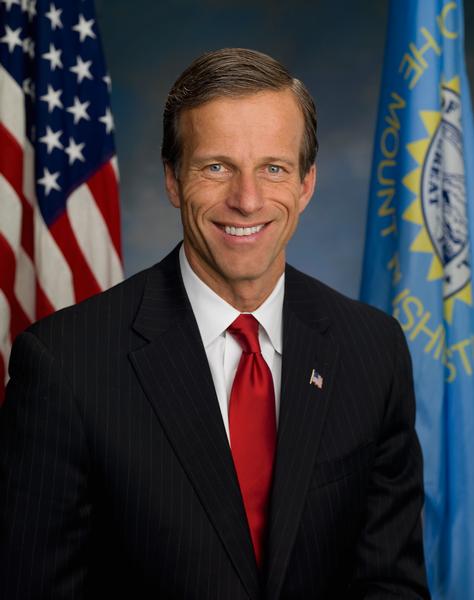

By Sen. John Thune

Government can’t create prosperity, but it can and should cultivate opportunity. Too often, government stifles opportunity and gets in the way of hardworking South Dakotans. Before Republican-led tax reform five years ago, the federal tax code was doing just that, leaving our economy stuck in neutral. Tax reform played a key role in reversing this sluggishness and fostering a healthy economic environment that promoted growth and opportunity for all. Fully preserving key elements of tax reform and stopping Democrats’ reckless big-government policies are essential to restoring this economic strength.

Tax reform delivered on Republicans’ promise of a pro-growth and pro-worker economy by modernizing the tax system with lower rates and simpler rules. Tax cuts meant South Dakotans, and all Americans in every income bracket, saw bigger paychecks. Businesses of all sizes, including farms and ranches, took advantage of lower rates and a simpler tax system by increasing investment in themselves and their employees. And by reducing our sky-high corporate tax rate, which until tax reform was the highest in the industrialized world, we made the United States a more competitive place to do business, bringing jobs and production back to America.

The effect of these reforms was that our economy was firing on all cylinders. Companies passed tax savings on to workers with increased paychecks and benefits. South Dakota utility companies lowered utility bills in our state. The national unemployment and poverty rates fell to record lows as the income gap narrowed, and lower- and middle-income Americans saw some of the greatest benefits. And the government has even collected record-high revenues while individual Americans are paying less in taxes.

Reversing key elements of tax reform, or allowing provisions to expire, as Democrats have suggested, would reduce opportunity and raise taxes on South Dakotans whose budgets are already strained by the historic inflation Democrats’ reckless spending helped create. To make matters worse, at the beginning of this year, a series of Democrat-led tax hikes went into effect. These new and unnecessary tax hikes will drive energy bills even higher and lead to lower wages and depressed job growth.

In addition to new tax burdens on Americans, the Biden administration will move forward this year with plans to supersize the IRS. Under the Democrats’ so-called Inflation Reduction Act, the IRS was given $80 billion – or almost six times its annual budget – to hire as many as 87,000 new agency employees. With more than half the funding going toward enforcement and just 4 percent going to improve the agency’s lackluster customer service, I’m concerned the only real changes will be increased audits on middle-income families and small businesses.

Stopping this unnecessary expansion of government is a top Republican priority. When the Senate considered the Inflation Reduction Act in August, Republicans offered amendments – which Democrats unanimously rejected – that would have blocked the IRS expansion and protected small businesses and middle-income taxpayers from increased audits. In addition, I have introduced multiple bills to help rein in the IRS and add much-needed accountability. And the new Republican majority in the House has already made repealing IRS expansion one of its first orders of business in the new Congress.

More government is most often the problem, not the solution. When it comes to getting our economy moving again, bigger government, increased regulations, and higher taxes are definitely not the solution. Republicans know that the strength of the American economy is the working families, small business owners, farmers, and ranchers who work hard every day for a chance at their American dream. Tax reform helped create an economic environment that set people up for a more secure future. We should build on these successes and strive to provide more opportunity for South Dakotans, not less.

###

IRS agents are police, focusing on tax laws. Why is John Thune trying to abolish the police? Every other crime is on the radar to expand police, but if you make enough money to be able to cheat on taxes, it is okay? I don’t understand this, change the tax code so I can cheat too then, and not just the 7+ figure tax returners.

Please explain how those “7+ figure tax returners” are cheating on their taxes. Please give specific examples of how they are openly cheating on their taxes and getting away with the alleged cheating.

Site the law/regulation/rule and the line or form on their tax returns that are in open violation of the law.

Or are you just parroting more of the short boy’s talking points from the national socialist blog, Nebraska chapter?

I can’t provide that data, it isn’t public, but we have gutted the agency as soon as Trump took office in 2017. Tax fraud cases have dropped almost 40% since 2017 (US sentencing commission, August 2022). I don’t believe that is due to the sudden stop of people committing fraud.

I don’t have access to other peoples tax returns, but I know my own, and options to commit fraud. Since the Trump tax revision, the standard deduction now exceeds most of our potential charitable donations and losses on real estate (non-primary residence only) we can handle. Due to that $26k standard deduction (married filing jointly), most households not making huge income don’t have the option to itemize without suspicion. However, if you do still itemize, and have a lot of information, like 1000’s of pages, chances are you’ll be able to sneak in an extra $20k donation, etc.

I don’t know what a short boy talking point is, but this is my personal experience in understanding tax code and doing my own taxes. I don’t agree with some people cheating because they make a lot, and we should have law enforcement for those laws. Follow the law like the rest of us, regardless of how much money you donate to “politicians”.

“I don’t know”

“I don’t have”

But yet you can make positive accusations of certain individuals committing tax fraud.

argumentum ad ignorantiam

The evidence and loophole opportunity is obviously there. Your request for proof is an argument from ignorance, and not possible.

Can we reduce the local police force since crime has been going down? Can you provide any proof that crime is being committed that we are not catching, if not, then lets cut the police force.